Farm Management

In mid-August, the US Bureau of Labor Statistics announced the Consumer Price Index (CPI) for July 2024. The CPI represents a composite measure of price changes for a bundle of essential goods and services used by households. In other words, this measure reflects the inflation rate in the economy.

According to the Bureau’s calculations, the US annual CPI rate decreased to 2.9 percent in July 2024, the lowest inflation rate since March 2021, after reaching a peak of 9.1 percent in June 2022. This recent decrease suggests that the Federal Reserve’s aggressive interest rate policies are beginning to yield the desired results. However, media reports indicate that many consumers nationwide continue to struggle to feed their families as the inflation rate is still above the Federal Reserve’s 2 percent target.

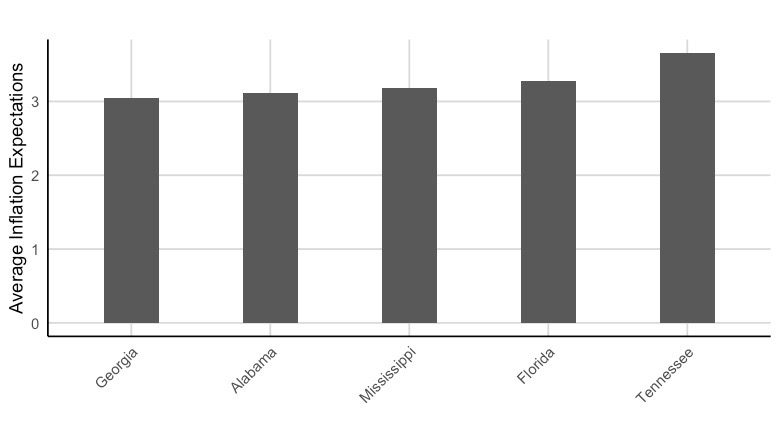

Figure 1. Year-over-year inflation expectations from August 2024.

Researchers at the Auburn University Experimental Economics Laboratory, led by Samir Huseynov, conducted a survey in December 2023 with approximately 150 participants to assess households’ food affordability in Alabama and neighboring states. The study measured participants’ medium-term inflation rate expectations for August 2024, alongside their food affordability challenges. Adjusting food consumption behaviors to cope with rising prices usually requires some time. Therefore, the study focused on how households’ nine-month-ahead inflation expectations shaped their forward-looking food consumption planning.

Consumer Inflation Expectations

Figure 1 shows that households expected inflation to hover around the 3 percent level, indicating their expectation that high price levels would persist in the market. The study results also highlight noticeable differences in inflation expectations across states. This may suggest that state-specific economic dynamics could lead to varying local price levels. Inflation predictions from Alabama households were very close to the national average (3.1 percent), while participants from Tennessee had a more pessimistic outlook, predicting a higher inflation rate of 3.7 percent.

Consumer Strategies to Manage Food Inflation

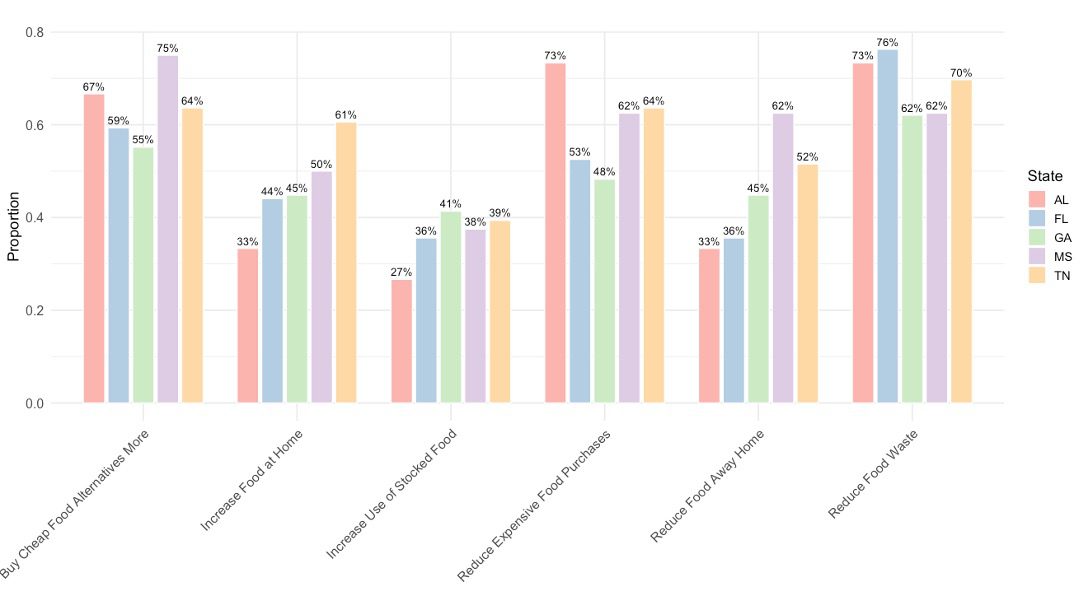

Figure 2. Food affordability measures for Alabama and neighboring states.

Figure 2 illustrates that differences in inflation rate expectations also impacted food affordability and consumption planning. Only 33 percent of Alabama participants stated they would increase food-at-home consumption in response to rising food prices. However, the proportions of households planning to dine at home more frequently were 50 percent in Mississippi and 61 percent in Tennessee. These shifts toward more food at home are likely due to the differences in price changes for the two categories. Food-at-home prices are up 1.1 percent over the past year compared to an increase of 4.1 percent for food away from home.

Alabamians also planned to reduce expensive food purchases and substitute them with cheaper alternatives such as generic or store brands. Additionally, participants mentioned reducing food waste as a coping strategy to deal with high grocery prices.

The researchers also conducted formal statistical analyses to identify how inflation expectations affect food planning. The results indicate that households with higher inflation rate expectations planned to reduce the purchase of relatively expensive food products and opt to consume previously stocked food items.

Takeaways

While inflation has declined in 2024, consumers are still dealing with high food prices. Alabama residents expressed plans to adapt to these high prices by reducing food waste and reducing expensive food purchases. The researchers plan to continue their investigation of food-affordability issues for Alabama residents.

For more information on inflation and the general economy, check out the following articles:

- https://www.aces.edu/blog/topics/home-family/extension-economist-provides-guide-to-understanding-the-economy/

- https://www.aces.edu/blog/topics/home-family/relief-on-the-way-extension-economist-says-inflation-approaching-pre-pandemic-levels/

- https://www.aces.edu/blog/topics/farm-management/rising-rates-and-food-consumption-how-auburn-and-opelika-residents-feel-the-feds-fight-against-inflation/