Home & Family

AUBURN UNIVERSITY, Ala. — Do you ever get a little lost when it comes to the economy? GDP, inflation, interest rates, the Federal Reserve; the list of terms goes on and on, but what does it all mean? On top of the lingo, you often see one source saying the economy is bad and another saying it is good. Which one is correct? To help sort through some of this, Wendiam Sawadgo, an Alabama Cooperative Extension System economist, provides much-needed insight.

Key Economic Metrics

Is there one single metric that consumers can look at to determine if the economy is good or bad? In short, the answer is no. While one metric may show great economic numbers, other areas may tell a different story. That is why it is important for consumers to look at the full picture to get a solid understanding of the state of the economy. Sawadgo said there are many elements that characterize a good economy.

“Real gross domestic product (GDP) measures economic growth,” Sawadgo said. “The inflation rate measures price stability, and the unemployment and employment rates help measure the strength of labor markets. Over the past few years, we have had relatively strong labor markets and economic growth but persistent unstable prices. In other words, the economy has been mixed.”

The consumer price index (CPI) is also a metric that people can look to. This index provides a look into how prices of commonly used goods, such as fuel, have changed over time. Economists use the data the CPI provides to calculate the inflation rate.

“People may care about vastly different measures in their personal lives, and they are not wrong for doing so,” Sawadgo said. “For example, gas prices, housing prices, grocery-store expenditures and income are all factors that are important to different people. The CPI is often use to account for these factors that affect people every day.”

Sawadgo said over the past couple years, inflation has been a key metric that consumers looked at because it affected what they were able to buy. The GDP and unemployment rate were also important metrics. Currently, inflation is expected to continue approaching the Federal Reserve’s target of 2%. According to Sawadgo, the GDP has been decent, with the rates from the two most-recent quarters being 3.3 and 4.9%. In 2023, the unemployment rate reached at 50-year low.

Common Misconceptions

At times — especially when metrics are indicating a poor economy — common misconceptions about the economy begin circulating the web and other outlets. This is especially true when it comes to policy and prices.

Policy

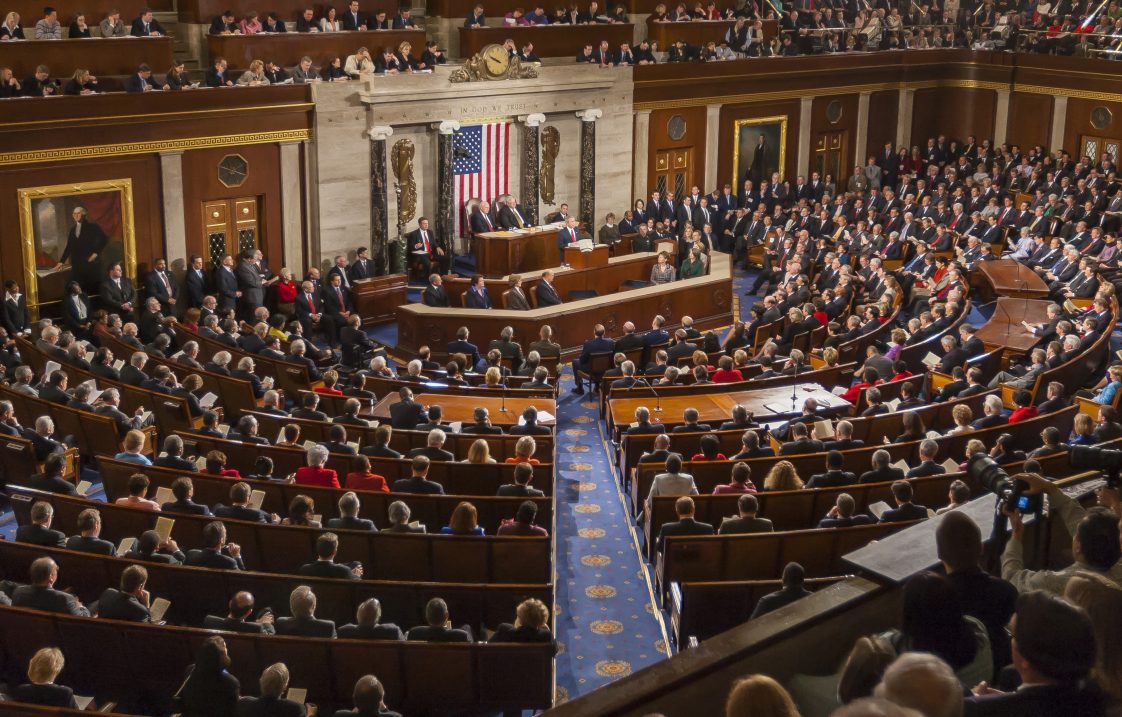

The term macroeconomics is used when discussing elements related to the economy as a whole. Primarily, there are two types of policy within the government that affect the macroeconomy: fiscal and monetary.

The term macroeconomics is used when discussing elements related to the economy as a whole. Primarily, there are two types of policy within the government that affect the macroeconomy: fiscal and monetary.

“The economy involves a lot of people and complicated interactions, so there isn’t one simple action or one level to fix the economy,” Sawadgo said. “There is also significant lag time between when a policy action takes place and when we see an effect in the real world.”

Fiscal policy involves items enacted by the federal government such as taxation, government spending and borrowing. Monetary policy, however, does not involve the federal government. An entity known as the Federal Reserve is responsible for monetary policy. You can think of this entity as the central bank of the U.S.

“The Federal Reserve is independent from the federal government,” Sawadgo said. “So, if someone says the president raised interest rates, this is not how it works, because the Federal Reserve is autonomous.”

Prices

In the economy, there are two types of prices: nominal and real. It is important to understand their differences, as the use of one or the other can greatly affect the meaning of the information you encounter.

“Nominal prices are the dollar value used at a certain point in time,” Sawadgo said. “In contrast, real prices account for the purchasing power of money by deflating nominal values by a price index.”

For example, you may read something that compares U.S. median household incomes from two separate years. If the income in 1990 was $29,940 and in 2022 was $74,580, Sawadgo said these are both nominal values for what people made at those times.

However, real prices in this example would be different because both values would be measured in 2022 dollars. The real price in 1990 would then be $61,500. This allows consumers to directly compare the two incomes because they are now both adjusted by the CPI.

“Context is always important to know,” Sawadgo said. “If you see a meme saying that the median income has not increased but housing prices have gone up a lot, make sure that it is comparing real prices to real prices or nominal prices to nominal prices. Comparing nominal prices to real prices would not be a fair representation.”

More Information

While complex, understanding the economy is an important part of being a consumer. It will better prepare you to make sound financial decisions. For more economic and financial information, you can rely on Alabama Extension specialists and agents. Learn more by visiting the Extension website, www.aces.edu, or contacting your county Extension office.