Finance & Career

FAFSA Purpose and Process

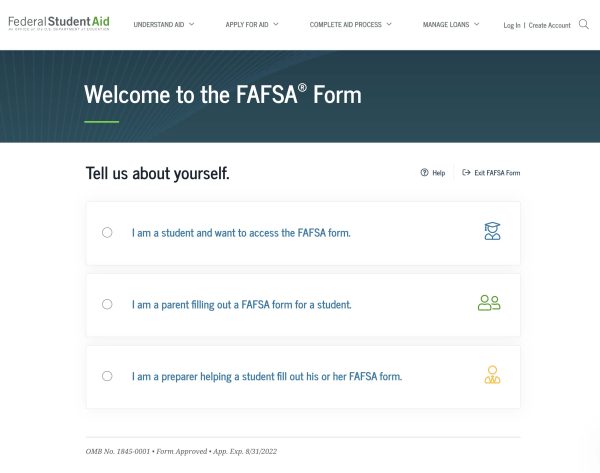

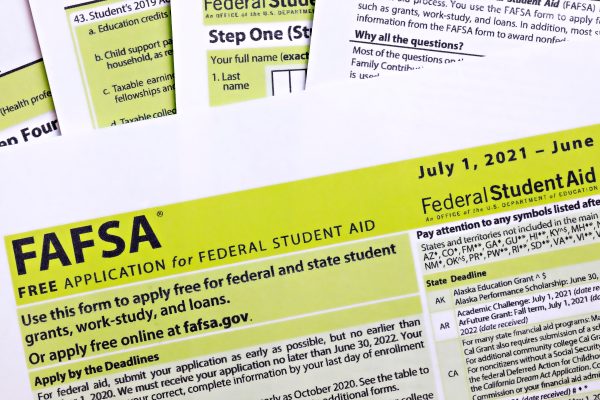

The Free Application for Federal Student Aid, often referred to as FAFSA, is a form a person must complete to get college financial aid from the federal government. As the name suggests, the application process is entirely free. Through FAFSA, the US Department of Education gives more than $120 billion to college students each year through grants.

Plan Ahead > Complete the FAFSA Form > Review Award Offer & Accept Award > Renew & Repay

Who Is Eligible for FAFSA?

Basic eligibility requirements:

- Have a financial need (for most but not all programs).

- Student has a financial need if the cost to attend school (cost of attendance, COA) is more than the family is expected to contribute (expected family contribution, EFC).

- EFC is calculated based on the information the parent and student enter on the FAFSA form. It is not the amount the family will pay for college. It is just a formula used to calculate aid amount.

- Have US citizenship or be an eligible non-citizen.

- For a list of eligible non-citizens, visit https://studentaid.gov/understand-aid/eligibility/requirements.

- Have a Social Security number.

- Enrolled or accepted for enrollment at an eligible degree or certificate program.

- Enrolled at least half-time in an eligible degree or certificate program.

- Maintain satisfactory academic progress.

- Sign the certification statement on the FAFSA form.

- Have a high school diploma, General Educational Development (GED) certificate, state-approved homeschool diploma, or eligible career pathway program.

Plan Ahead

Plan Ahead

- Gather social security number, alien registration number, federal tax returns, bank account balances, investment records, and other income sources.

- Create an FSA ID at www.studentaid.gov/fsaid.com. Student and parent/guardian will each need to create an FSA ID.

- Save for college and consider education savings (529) plans.

- Research college and university costs, financial aid options, time lines, and deadlines.

- Research scholarships and grants from for-profit and nonprofit organizations.

- Complete the FAFSA form.

- Submit the FAFSA form. (It takes most people about 30 minutes to complete.)

- File in one of three easy ways:

- Electronically at www.fafsa.gov.

- Through the myStudentAid mobile app, available on the App Store (iOS) or Google Play (Android).

- Mail it: Call to request the FAFSA PDF at 1-800-4-FED-AID or (1-800) 433-3243 or download it from www.studentaid.gov.

- After the FAFSA form completion, the applicant should receive an email in a few days to confirm that the application was successfully processed. If the applicant does not receive an email, review the application again to ensure that there are no issues or omitted steps.

Review Offer and Accept Award

- Each college or school the student applied to will provide an aid offer letter.

- Compare each school based on the cost of attendance and the amount of aid offered.

- Accept the offer from the school the parent and student choose. The student will complete loan agreement forms and complete entrance counseling.

- The school financial aid office will handle the aid. After school tuition and fees are covered, any remaining balance will come directly to the student.

Renew and Repay

- Each year parent and student must renew the FAFSA form.

- Each year parent and student must stay eligible for aid, including meeting basic criteria and having satisfactory grades.

- Each year parent and student must accept the new award offer made.

- Once a student graduates or leaves school, the parent and student must begin to repay the loan when the student is no longer a full-time student for 6 months.

- Several payment plans are available based on the financial and family situation. See more details at https://studentaid.gov/manage-loans/repayment.

FAFSA Tip

Use a permanent email address to create the FSA ID and on any FAFSA forms. Do not use a temporary email, such as a high school email address. Using a permanent email address allows the student to use the same email throughout the college experience.

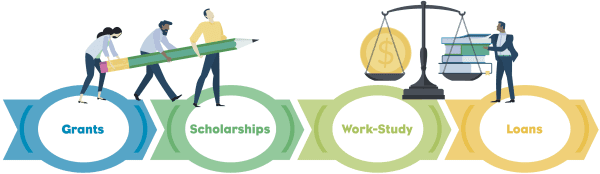

Types of Financial Assistance

Types of Financial Assistance: Grants, Scholarships, Work-Study, and Loans

Grants

- Do not have to be repaid.

- Several types of grants are available through FAFSA.

- Some forms of grants include Pell Grants, Federal Supplemental Educational Opportunity Grants (FSEOG), Teacher Education Assistance for College and Higher Education (TEACH) Grants, and Iraq and Afghanistan Service Grants.

Scholarships

- Do not have to be repaid.

- Often awarded from corporations, nonprofits, or other private or civic organizations.

- Can be awarded based on merit, need, talent, area of study, or organization affiliation.

- Sometimes require additional application criteria such as essays, transcripts, or recommendations.

Work-Study

- Federal work-study allows students to work on or off campus to pay for college.

- Work-study is available to enrolled students who have a financial need.

- Undergraduate, graduate, and professional students may qualify for full-time or part-time work-study.

Loans

- Federal student loans fall under the William D. Ford Federal Direct Loan (Direct Loan) Program.

- Four loan types:

- Direct Subsidized Loans for undergraduate students with financial need.

- Direct Unsubsidized Loans for undergraduate, graduate, and professional students regardless of need.

- Direct PLUS Loans for graduate or professional students and parents of dependent undergraduate students regardless of need; a credit check is required.

- Direct Consolidation Loans to combine all eligible federal student loans into one loan.

FAFSA Tip

Specific financial aid exists for foster care youth, military families, community service, and students who want to study internationally. Other local, state, and federal organizations also offer forms of aid. Check out these special programs on the US Department of Education’s Federal Student Aid website.

My FAFSA Checklist

Completing the annual FAFSA can take 30 minutes or less if you plan ahead. Your filer status as a dependent, independent, or eligible non-citizen student will determine the items you need to file. Use this checklist to collect your materials ahead of time to streamline the FAFSA filing process.

Completing the annual FAFSA can take 30 minutes or less if you plan ahead. Your filer status as a dependent, independent, or eligible non-citizen student will determine the items you need to file. Use this checklist to collect your materials ahead of time to streamline the FAFSA filing process.

All filers should have the following:

- Your driver’s license or state-issued ID

- Record of any other common income sources:

- Child support

- Social Security benefits

- Veteran benefits

- Military or clergy allowance

- Combat pay or special combat pay

- Taxable work-study, assistantships, fellowships, grants and scholarships

- FAFSA Title IV Institution codes for the schools you are applying to (search codes at https://studentaid.gov/fafsa- app/FSCsearch)

- Your student and parent FSA IDs if filing electronically (create or retrieve your FSA ID at www.studentaid.gov/fsaid)

Independent Student

You are an independent student if you are either at least 24 years old, married, graduate or professional student, veteran, member of the armed forces, orphan, ward of the court, someone with legal dependents other than a spouse, emancipated minor, or someone who is homeless or at risk of becoming homeless.

If you are a US citizen and independent student, you will need:

- Your Social Security card

- Your W-2 forms for the current (or prior) year

- Your federal income tax returns for the current or previous 2 years

- Your untaxed income records for the current year

- Your current bank statements

- Your current brokerage account statements, including stocks, bonds, mutual funds, and other investments

- Any record of a family change (i.e., marital status, living situation, separation), if applicable

- Any record of unusual financial circumstances (e.g., high non-reimbursed medical or dental expenses, high dependent care costs for a child or an elderly parent, salary reductions or job loss, private K–12 tuition)

- Any other statements of current income you and your parent/guardian may accrue (see Other Common Income Sources)

FAFSA Tip

If you or your parents have not yet completed your taxes for the current tax year, you can estimate your income and other tax return information for the purposes of FAFSA completion. Once you file your taxes for the current year, you can then correct your FAFSA application.

Dependent Student

You are a dependent student if you do not meet the criteria to be independent. Dependent students are presumed to have some parent or guardian support.

You are a dependent student if you do not meet the criteria to be independent. Dependent students are presumed to have some parent or guardian support.

If you are a US citizen and dependent student, you will need:

- Your Social Security card

- Your and your parent’s or guardian’s W-2 forms for the current (or prior) year

- Your and your parent’s or guardian’s federal income tax returns for the current year

- Your and your parent’s or guardian’s untaxed income records for the current year

- Your and your parent’s or guardian’s current bank statements q Your parent’s or guardian’s current business and investment records

- Your and your parent’s or guardian’s current brokerage account statements, including stocks, bonds, mutual funds, and other investments

- Any record of a family change (i.e., marital status, living situation, separation), if applicable

- Any record of unusual financial circumstances (e.g., high non-reimbursed medical or dental expenses, high dependent care costs for child or an elderly parent, salary reductions or job loss, private K–12 tuition)

- Any other statements of current income you and your parent/guardian may accrue (see Other Common Income Sources)

Eligible Non-Citizen

You are an eligible non-citizen if you are either a US permanent resident with a Permanent Resident Card (formerly known as an Alien Registration Receipt Card or “Green Card”), a conditional permanent resident (I-551C), other eligible non-citizen with an Arrival- Departure Record (I-94) from the Department of Homeland Security showing any one of the following designations: “Refugee,” “Asylum Granted,” “Indefinite Parole,” “Humanitarian Parole,” or “Cuban-Haitian Entrant,” citizen of the Republic of Palau (PW), the Republic of the Marshall Islands (MH), or the Federated States of Micronesia (FM).

An eligible non-citizen must enter an eight- or nine-digit Alien Registration Number (ARN) on FAFSA instead of a Social Security number.

If you are an eligible non-citizen student, you will need:

- Your alien registration number

- Your driver’s license or state-issued ID

- Your and your parent’s or guardian’s W-2 forms for the current (or prior) year

- Your and your parent’s or guardian’s federal income tax returns for the current (or prior) year

- Your and your parent’s or guardian’s untaxed income records for the current (or prior) year

- Your and your parent’s or guardian’s current bank statements

- Your parent/guardians’ current business and investment records

- Your and your parent’s or guardian’s current brokerage account statements, including stocks, bonds, mutual funds, and other investments

- Any record of a family change (i.e., marital status, living situation, separation), if applicable

- Any record of unusual financial circumstances (e.g., high non-reimbursed medical or dental expenses, high dependent care costs for a child or an elderly parent, salary reductions or job loss, private K–12 tuition)

- Any other statements of current income you and your parent or guardian may accrue (see Other Common Income Sources)

IRS Data Retrieval Tool

The IRS Data Retrieval Tool (IRS DRT) can help reduce the time spent collecting your financial information. IRS DRT can electronically import your federal tax return into the FAFSA form. It can also be used in the FAFSA repayment phase when completing the Income-Driven Repayment (IDR) plan requests.

The IRS Data Retrieval Tool (IRS DRT) can help reduce the time spent collecting your financial information. IRS DRT can electronically import your federal tax return into the FAFSA form. It can also be used in the FAFSA repayment phase when completing the Income-Driven Repayment (IDR) plan requests.

Why use the IRS DRT?

- It is easy. Instead of spending time manually collecting your financial details, you can transfer your information with the click of a button.

- It is accurate. There is no need to worry about incorrectly entering your information or making errors. This tool will enter all your information for you accurately.

- It reduces your paperwork and requires less documentation. Instead of collecting several financial documents to file FAFSA, you can use this tool to streamline the work for you.

Who can use the IRS DRT?

- The IRS DRT can be used by parents, guardians, and students filling out the FAFSA form. There are a few exceptions for those who do not qualify for using this tool. For more information on those who do not qualify, please check out the information at https://www.irs.gov/individuals/irs-offers-help-to-students-families-to-get-tax-information-for-student-financial-aid-applications.

Steps to use the IRS DRT:

Step 1. Start a new online FAFSA form or log in to an existing one on the fafsa.gov website.

Step 2. Navigate to the Finances section of the online FAFSA form. Click on the Link to IRS button. This button will only be present if you are eligible to use the IRS DRT.

Step 3. After clicking Link to IRS, log in using your FSA ID. This will transfer you to the IRS website to retrieve your information.

Step 4. Once at the IRS website, enter the prompted information about your federal income tax return. Make sure the information you enter is exactly how it appears on your tax return. You should always keep a copy of your completed tax returns, whether electronic or paper, in a secure place for your records. If you need a copy of your tax return, here are some options:

- If you used a tax software product to prepare and file your taxes, access the software to download a copy of your completed return.

- If you used a tax preparer to file your taxes, contact the preparer for a copy of your completed return.

- Request a copy of your completed tax return by filing a Form 4506-T with the IRS. To download a copy of the form, review applicable fee(s), processing time frames, and instructions on filing, and visit https://www.irs.gov/forms-pubs/about- form-4506-t.

Step 5. After entering your federal income tax return information, click the Submit button.

Step 6. Select the Transfer My Tax Information into the FAFSA form box on the screen, and then click the Transfer Now button.

Step 7. The words “Transferred from the IRS” will appear in place of the IRS information on your FAFSA form. Note that these words will appear for your protection, instead of your actual tax information. If these words do not appear, your federal tax return information did not successfully transfer. Go back and double-check each step.

For more information on the IRS DRT tool, visit StudentAid.gov/irsdrt.

FAFSA Tip

Remember to save your FAFSA information in a secure location. If keeping information on USBs, external hard drives, laptops, desktop computers, smartphones, tablets, or external servers, be sure that your files are password protected.

Back to Student & Family Guide to FAFSA

Portia Johnson, Extension Specialist, Assistant Professor, Auburn University; Kassandra Ross, Clinical Instructor of Marketing, University of Alabama; Emily Hines, Regional Extension Agent, Auburn University

Portia Johnson, Extension Specialist, Assistant Professor, Auburn University; Kassandra Ross, Clinical Instructor of Marketing, University of Alabama; Emily Hines, Regional Extension Agent, Auburn University

Contributions from Jill Prince, Career Coach Mentor, Alabama Board of Education; Monica Mack, Education Specialist, Alabama Board of Education; Theresa Jones, Regional Extension Agent, Auburn University; Patricia Smith, Regional Extension Agent, Auburn University; Renee Vines, Regional Extension Agent, Auburn University; Cynthia White, Regional Extension Agent, Auburn University

New August 2022, Student & Family Guide to FAFSA, FCS-2639