Finance & Career

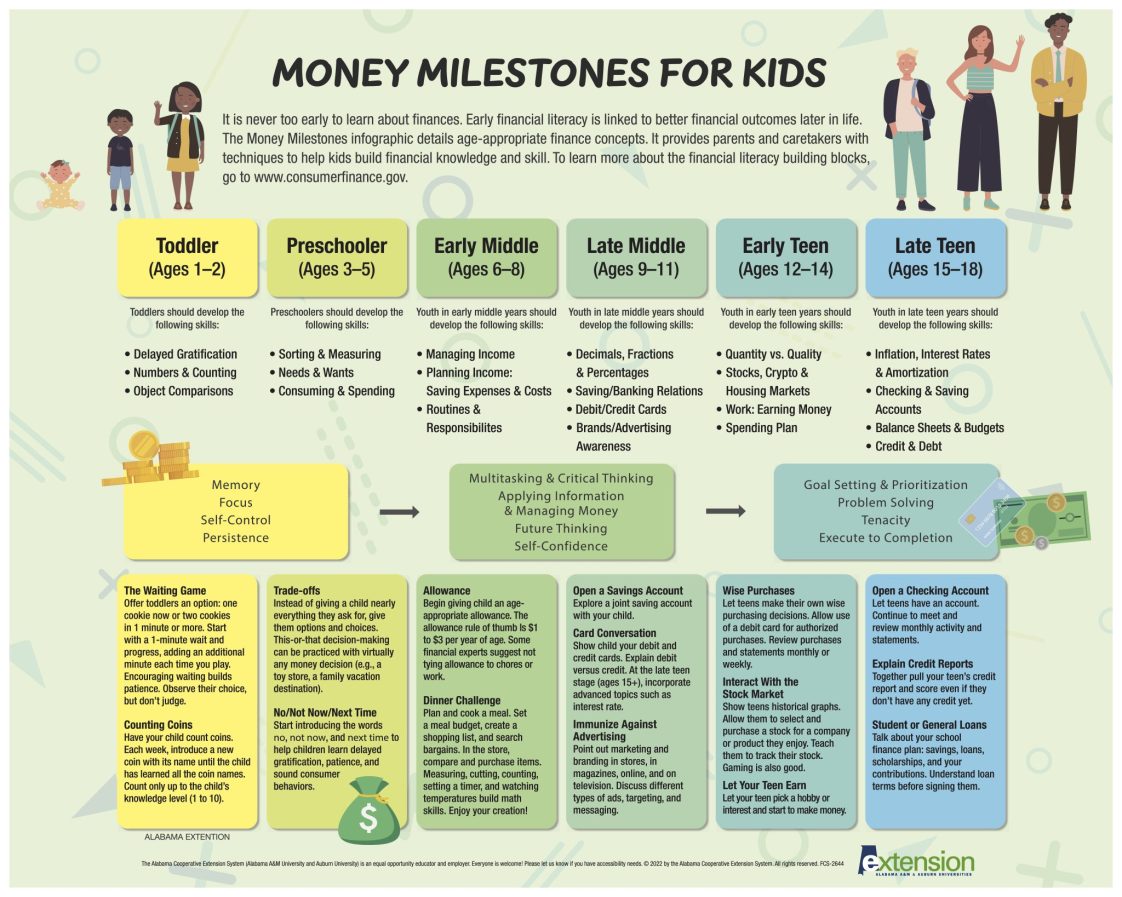

It is never too early to learn about finances. Early financial literacy is linked to better financial outcomes later in life. The Money Milestones infographic details age-appropriate finance concepts. It provides parents and caretakers with techniques to help kids build financial knowledge and skill. To learn more about the financial literacy building blocks, go to www.consumerfinance.gov.

Toddler (Ages 1–2)

Toddlers should develop the following skills:

- Delayed Gratification

- Numbers & Counting

- Object Comparisons

The Waiting Game

Offer toddlers an option: one cookie now or two cookies in 1 minute or more. Start with a 1-minute wait and progress, adding an additional minute each time you play. Encouraging waiting builds patience. Observe their choice, but don’t judge.

Counting Coins

Have your child count coins. Each week, introduce a new coin with its name until the child has learned all the coin names. Count only up to the child’s knowledge level (1 to 10).

Preschooler (Ages 3–5)

Preschoolers should develop the following skills:

- Sorting & Measuring

- Needs & Wants

- Consuming & Spending

Trade-offs

Instead of giving a child nearly everything they ask for, give them options and choices. This-or-that decision-making can be practiced with virtually any money decision (e.g., a toy store, a family vacation destination).

No/Not Now/Next Time

Start introducing the words no, not now, and next time to help children learn delayed gratification, patience, and sound consumer behaviors.

Early Middle (Ages 6–8)

Youth in early middle years should develop the following skills:

- Managing Income

- Planning Income: Saving Expenses & Costs

- Routines & Responsibilities

Allowance

Begin giving child an age- appropriate allowance. The allowance rule of thumb Is $1 to $3 per year of age. Some financial experts suggest not tying allowance to chores or work.

Dinner Challenge

Plan and cook a meal. Set a meal budget, create a shopping list, and search bargains. In the store, compare and purchase items. Measuring, cutting, counting, setting a timer, and watching temperatures build math skills. Enjoy your creation!

Late Middle (Ages 9–11)

Youth in late middle years should develop the following skills:

- Decimals, Fractions & Percentages

- Saving/Banking Relations

- Debit/Credit Cards

- Brands/Advertising Awareness

Open a Savings Account

Explore a joint saving account with your child.

Card Conversation

Show child your debit and credit cards. Explain debit versus credit. At the late teen stage (ages 15+), incorporate advanced topics such as interest rate.

Immunize Against Advertising

Point out marketing and branding in stores, in magazines, online, and on television. Discuss different types of ads, targeting, and messaging.

Early Teen (Ages 12–14)

Youth in early teen years should develop the following skills:

- Quantity vs. Quality

- Stocks, Crypto & Housing Markets

- Work: Earning Money

- Spending Plan

Wise Purchases

Let teens make their own wise purchasing decisions. Allow use of a debit card for authorized purchases. Review purchases and statements monthly or weekly.

Interact With the Stock Market

Show teens historical graphs. Allow them to select and purchase a stock for a company or product they enjoy. Teach them to track their stock. Gaming is also good.

Let Your Teen Earn

Let your teen pick a hobby or interest and start to make money.

Late Teen (Ages 15–18)

Youth in late teen years should develop the following skills:

- Inflation, Interest Rates & Amortization

- Checking & Saving Accounts

- Balance Sheets & Budgets

- Credit & Debt

Open a Checking Account

Let teens have an account. Continue to meet and review monthly activity and statements.

Explain Credit Reports

Together pull your teen’s credit report and score even if they don’t have any credit yet.

Student or General Loans

Talk about your school finance plan: savings, loans, scholarships, and your contributions. Understand loan terms before signing them.

Concepts Developed by Age Group

Toddler/Preschooler

- Memory

- Focus

- Self-Control

- Persistence

Early Middle/Late Middle

- Multitasking & Critical Thinking

- Applying Information & Managing Money

- Future Thinking

- Self-Confidence

Early Teen/Late Teen

- Goal Setting & Prioritization

- Problem Solving

- Tenacity

- Execute to Completion

Portia Johnson, Extension Specialist, Assistant Professor, Auburn University

New March 2022, Money Milestones for Kids, FCS-2644