Finance & Career

A critical step in getting ready for a financial long haul is setting up a rainy day fund—an emergency savings account of between $500 and $1,000 to cover unexpected challenges, such as repairing the brakes on your car, buying a new pair of shoes for one of your children, or caring for a sick parent.

A critical step in getting ready for a financial long haul is setting up a rainy day fund—an emergency savings account of between $500 and $1,000 to cover unexpected challenges, such as repairing the brakes on your car, buying a new pair of shoes for one of your children, or caring for a sick parent.

This rainy day fund not only allows you to cover these unexpected expenses but also gives you peace of mind that you can meet emergencies when they arise. In many cases, rainy day funds can mean the difference between staying afloat during hard economic times and sinking financially. The lack of rainy day funds often explains why so many people borrow money at high interest rates through payday loans and other traps.

Keep these emergency savings in a bank or credit union savings account, which offers easier access to your money than do certificates of deposit, savings bonds, or mutual funds. Keeping this money in a savings account rather than in a checking account also makes it much less likely that you will use it to pay for everyday, nonemergency-related expenses.

You will generally need a minimum of $100 to open a savings account and a $200 minimum balance to afford monthly fees. Some banks and credit unions may also waive these minimums if you have other accounts with them.

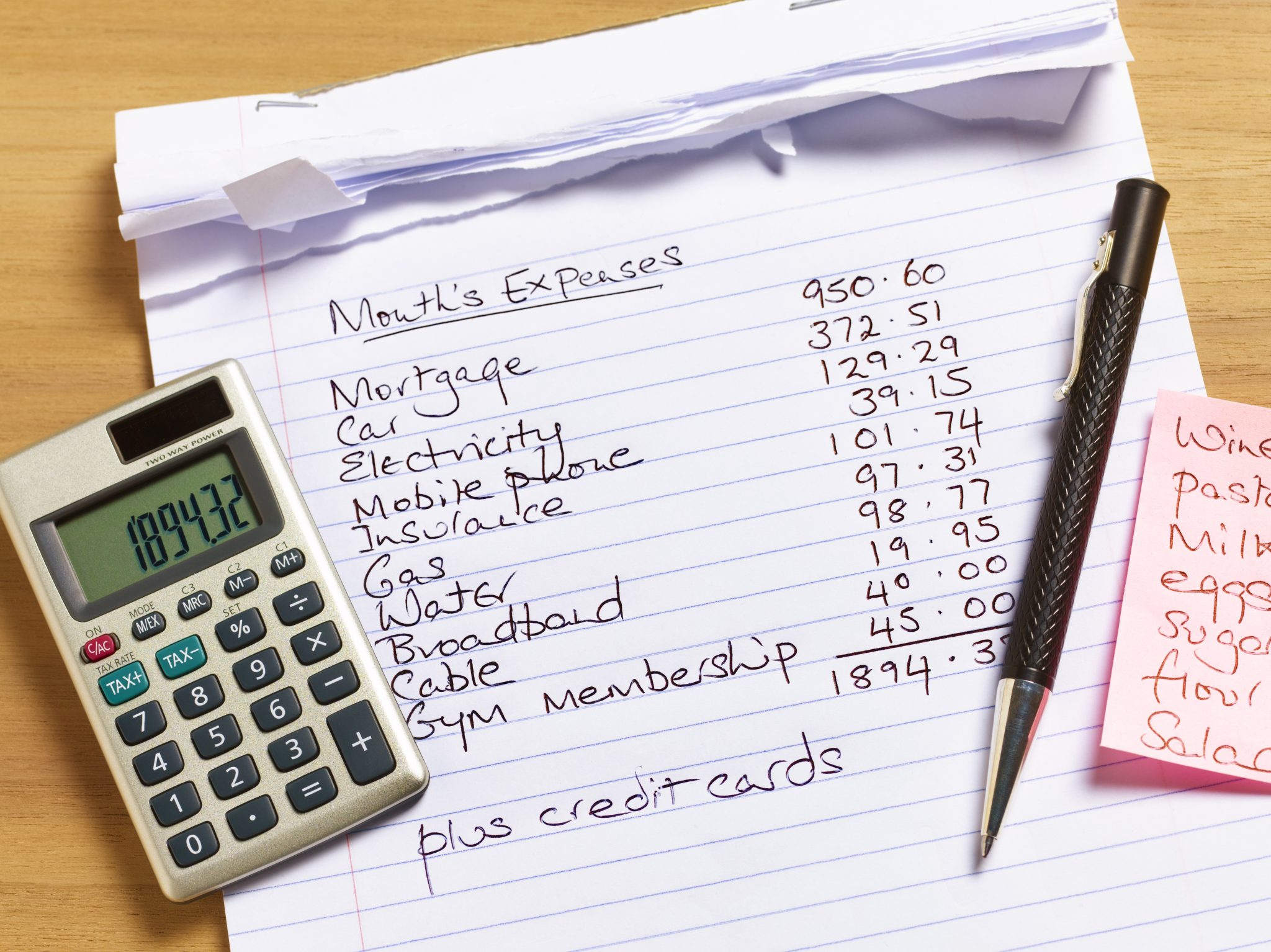

How do you find money to save? Start with loose change, which may enable you to save as much as $100 a year. Use this to open a savings account. If you receive a tax refund or earned income credit, use a portion of this money to begin a savings account or to increase the one you have.

Tax credits average nearly $2,000 a year, which may be enough not only to establish an account but also to pay off some or all of your debts.

Building an emergency fund is often easier when you involve all of your family in the effort. Everyone can help reduce energy use, food and entertainment costs, and other expenses. Another way to build a rainy day account is to request that your bank or credit union transfer funds each month directly from your checking account to your savings account. What you don’t see, you don’t miss.

Look for even more ways to save.Check the Alabama Extension website at www.aces.edu for more information about how to save and reduce debt. America Saves is a national campaign involving more than 1,000 nonprofit, government, and corporate groups that encourage individuals and families to save and build personal wealth. Learn more at www.americasaves.org.