Farm Management

The negative effects of COVID-19 have been felt in every industry in every corner of the country. The links between seemingly disconnected industries are becoming more and more noticeable.

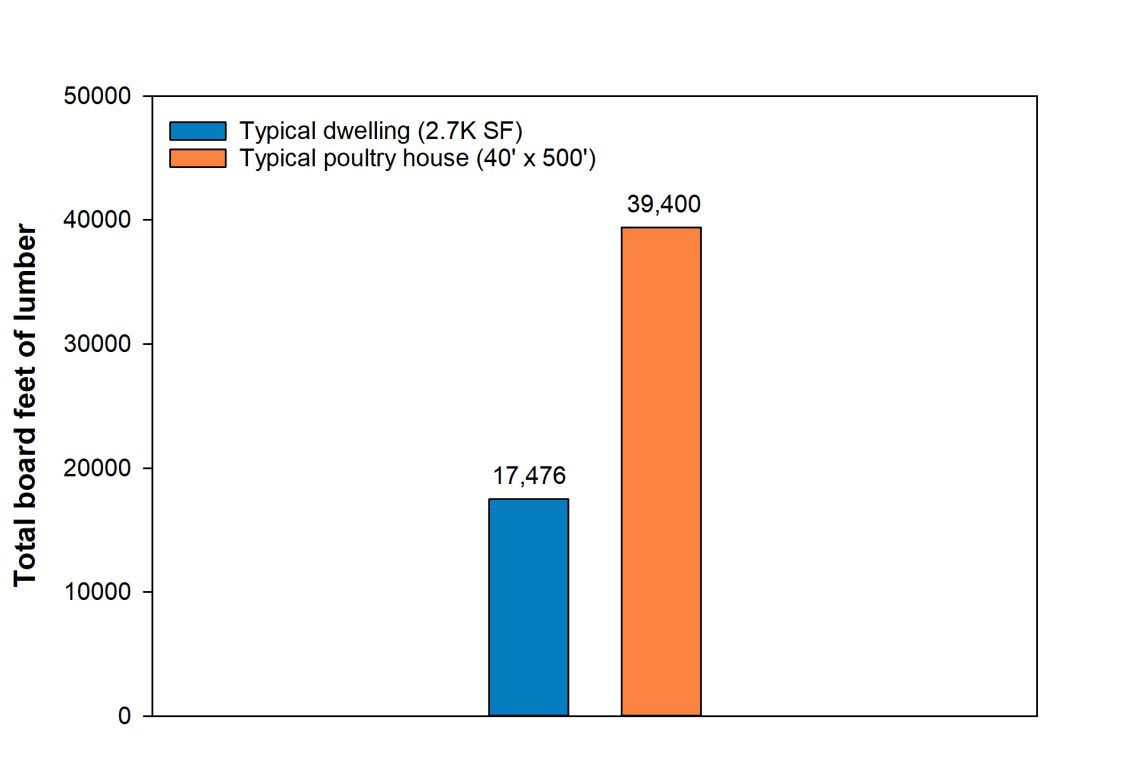

One such tie is between lumber and commercial poultry. Ask yourself, “What do wood and chickens have to do with each other?” Then consider that the chicken sandwich you had for lunch was processed from a bird raised in a chicken house, or “barn,” almost exclusively constructed of wood as the primary framing material. And it takes a lot of wood to build a modern chicken house. A typical commercial poultry house uses 60 percent more board feet of lumber than a single-family home (figure 1). The percentage of lumber to final structure cost is also higher, averaging 35 percent to 45 percent for the poultry house and 17 percent for the average single-family home Thus, changes in lumber price have a greater impact on poultry house costs.

Figure 1. A typical commercial poultry house uses 60 percent more board feet of lumber than a single-family house requires.

The United States lumber market during the COVID-19 pandemic has been under extreme strain and prices have risen to all-time highs. The causes are multifaceted and have severely hampered new housing efforts in commercial poultry. This has the potential to restrict future chicken supply and cause price inflation of poultry. In other words, your chicken sandwich could cost a little more next year if the current situation lingers.

Lumber Situation Going into Spring of 2020

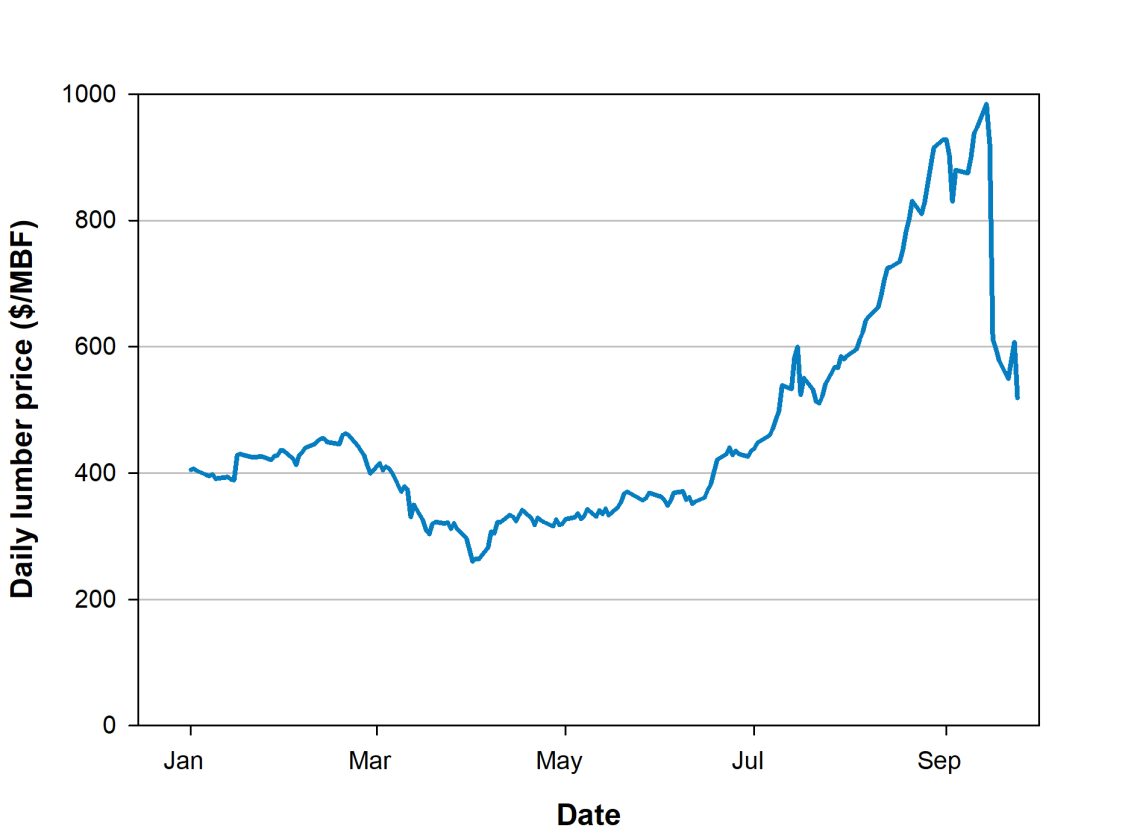

Going into the spring of 2020, the strong housing market of 2019 was continuing its pace and pulling on the supply of lumber. The strength of the housing market was driven by high demand for new housing starts, low mortgage interest rates, and low unemployment. Interest rates for home mortgages on average ranged between 3.2 percent and 3.5 percent. Average US lumber prices were approximately $402 per thousand board feet (MBF) to start the year and increasing to approximately $457 MBF toward the latter half of February. Initially, COVID-19 affected lumber production and overall capacity across the southern United States. Lumber mill managers had to follow Centers for Disease Control and Prevention (CDC) COVID-19 operating guidelines, such as social distancing and a maximum number of people in an area at one time. Many mills transitioned from the typical three shifts per day to two shifts. It was expected that the housing market would weaken and the demand for lumber would decrease as a result of a slowed economy. During the month of March, lumber prices steadily declined and bottomed out at the beginning of April at approximately $264 MBF before starting to slowly rise in price through May and the first part of June, reaching approximately $350 MBF before increasing exponentially through the summer months.

The recent increase in lumber prices is due to several short-term factors merging at the same time.

- Strong reductions in lumber production and capacity as a result of COVID-19 and the resulting safety guidelines.

- The real-time demand growth from home renovations.

- Market speculation from the producers, wholesalers, and retailers.

Figure 2. Lumber prices made a turn upward in April 2020 and made exponential gains from early July to mid-September when they began to return to a more normal level.

The combination of these factors ultimately paved the way to a shortage in lumber and an increase in its price. During the second quarter of 2020, home renovation projects soared as more people were staying at home following quarantine orders. Further, housing starts accelerated. Wholesalers and retailers were not expecting such an increase in the demand for lumber, and inventories were planned accordingly. Because of this unexpected demand, market speculation ensued and many wholesalers, retailers, and consumers started the panic buying of lumber. As a result, softwood lumber inventories were depleted, and the reduction in lumber production and capacity of mills magnified the situation. The price for lumber continued to increase. All these factors were the perfect storm to bring about an extremely stressed supply chain and extremely high prices, as illustrated in figure 2.

The combination of these factors has resulted in a tremendous supply gap in the lumber market. As of the second week of September, lumber prices were nearing a new record high at approximately $989 per MBF. The issue appeared to be more a result of a restraint on the supply of lumber than on an expanding market. Lumber production and consumption in April 2021 are still behind 2019 values, as is the pace of new homes being built.

Effects on the Poultry Industry

As noted earlier, the construction of a modern poultry house uses a tremendous amount of lumber and wood products. The current situation has caused several new poultry farms to stop building in mid-construction because of lumber shortages. The building of many new farms is simply delayed indefinitely because of the explosion in material costs upwards of 150 percent by many accounts. Treated lumber, which makes up as much as a quarter of the lumber in a poultry house, has taken an especially hard hit in supply and price. The total effect of these price increases has a typical 54′ x 500′ poultry house rising in cost as much as 20 percent ($25,000 to $30,000) in just a few months. Some areas have seen even steeper increases. This means a typical four-house poultry farm could see an increase of $100,000-plus in construction costs. The financial reality is that neither growers nor integrators nor builders can afford to absorb such cost increases with any expectation of profitability on these new farms. This has resulted in many bids for new poultry house construction being canceled, leaving growers, builders, and integrators with an uncertain future. One major poultry company estimates the construction of at least 250 new houses across its business units are being delayed, which could hinder the future placement of more than six million birds. Other companies have put normal building programs on hold in all but the most desperate situations. The stalled housing is also causing management headaches. In some cases, pullets are in place with no henhouse to go to once they reach maturity.

What Does the Future Hold?

On the positive side, there is plenty of raw material ready to be cut and processed in the United States. By most accounts, lumber mills are set to return to 100 percent capacity quickly once allowed. In a matter of days following the peak in price in the second week of September, lumber prices decreased steeply as lumber production began closing the supply gap. Lumber prices were expected to remain volatile for the remainder of 2020 from uncertainties over the pandemic, the housing market, and the economy. However, if production can continue and the economy stays healthy in the next 6 to 8 months, lumber prices will likely stabilize and trend back down to price levels similar to the start of 2020.

In the short to mid term, it could serve poultry growers, builders, and integrators well to consider possible alternatives to dimensional lumber, when possible. Such opportunities to consider include the following:

- Replacing all the 2 x 4 purlins with metal hat channel purlins

- Replacing treated lumber with composite wood

- Using alternative sheathing material other than OSB or plywood on the inside wall

- Generally, using alternatives to traditional lumber components wherever possible

Switching to alternative building material components will often include changing fasteners and possibly the underlying support structure, so builders must consider all the possible needed changes. Also, it is extremely important to note that any change in material components should be vetted with the poultry house design engineer before a change is implemented and that the designing engineer’s directions be followed explicitly. With that in mind, available alternatives could prove less expensive than traditional choices in the short term and could allow stalled building to go forward without losing overall farm profitability. However, the latest reports have shown that some of the alternatives, steel, for example, have already begun to increase in price because of the overall building market demand. All integrators, builders, and growers must look at their situation to decide whether alternatives are economically feasible or if they should delay their projects in hopes of a lumber supply rebound that will surely come.

The tight margins of the modern poultry farm demand continued innovation. In the longer term, designs using full steel structures; polyurea over spray foam for sidewalls; plastic/poly sheathing and even cross- laminated timber (CLT), a form of mass timber product, should be explored for future poultry house construction in the United States. The economic benefits could include increased building speeds, better structural consistency across the farm, and increased structural longevity with decreased maintenance as well as some insulation from the volatile lumber market. All could potentially add to long-term profitability and help secure the future of the affordable chicken sandwich.

References

Author evaluation of current poultry house bids

The House Designers

The National Association of Home Builders

Dennis Brothers, Associate Extension Professor, Agricultural Economics and Rural Sociology, and Adam Maggard, Extension Specialist, Assistant Professor, Forestry and Wildlife Sciences, both with Auburn University

Dennis Brothers, Associate Extension Professor, Agricultural Economics and Rural Sociology, and Adam Maggard, Extension Specialist, Assistant Professor, Forestry and Wildlife Sciences, both with Auburn University

Reviewed January 2025, How Lumber Affects the Chicken Sandwich, ANR-2750