Finance & Career

It is time for the 2025 tax season. This means that individuals and business are preparing to file taxes for the year 2024. For many, taxes can seem like a scary word. The following information is designed to take some guesswork out of taxes for you.

It is important to understand your federal and state tax liability or responsibility. The amount of taxes you pay depends firstly on your income level and your filing status. You likely know your yearly income, but do you know your filing status? Filing status depends on your relationship type. Are you single? Are you married but plan to file your taxes separately? Do you plan to file taxes together with your spouse? Are you widowed? Or are you the head of a household? The answer to these questions helps determine how much tax you pay. Filing status is also important because it is the building block for your taxes. It will determine the standard deduction amount, certain credits, and more that you are entitled to receive.

Tax Status and Bracket

The IRS has five filing statuses: single, married filing jointly, married filing separately, head of household, and qualifying widow or widower with dependent child.

Table 1. Internal Revenue Service Tax Filer Status

| Tax Filer Status | Qualifiers |

|---|---|

| Single | Unmarried, divorced. |

| Legally separated under a divorce. | |

| Married Filing Jointly | Married. (When a spouse passes away, the widowed spouse can usually file a joint return for that year.) |

| Married Filing Separately | Married and decide to each complete an individual tax return. |

| If filing jointly would result in more taxes owed, a married couple may select to file separately. | |

| Head of Household | Legally single/not married. |

| Pays more than half the household’s expenses. | |

| A dependent living with you or you have paid more than half a decedent’s living costs elsewhere. | |

| Qualifying Widow(er) with Dependent Child | The spouse died within the last 2 years and there is a dependent child. |

Your filing status and taxable income (instead of gross/total income) work together to determine your tax bracket.

A tax bracket is a range of income that is taxed at a certain rate. That rate is the amount of income that you are expected to pay in taxes. The US has a progressive tax system. This means, the more income you make, the higher your tax bracket. The good news is that you are not taxed on your gross income (all of the income you make). Simply put, a tax bracket is based off of your taxable income only. Your taxable income is usually less than your gross (total) income because deductions can reduce your taxed income.

There are seven tax brackets in 2024, which are detailed in tables 2 through 5.

Table 2. Single Taxpayers

| Tax Rate | On Taxable Income From | Up To |

|---|---|---|

| 10% | $0 | $11,600 |

| 12% | $11,601 | $47,150 |

| 22% | $47,151 | $100,525 |

| 24% | $100,526 | $191,950 |

| 32% | $191,951 | $243,725 |

| 35% | $243,726 | $609,350 |

| 37% | $609,351 | And up |

Table 3. Married Filing Jointly or Qualifying Surviving Spouse

| Tax Rate | On Taxable Income From | Up To |

|---|---|---|

| 10% | $0 | $23,200 |

| 12% | $23,201 | $94,300 |

| 22% | $94,301 | $201,050 |

| 24% | $201,051 | $383,900 |

| 32% | $383,901 | $487,450 |

| 35% | $487,451 | $731,200 |

| 37% | $731,201 | And up |

Table 4. Married Filing Separately

| Tax Rate | On Taxable Income From | Up To |

|---|---|---|

| 10% | $0 | $11,600 |

| 12% | $11,601 | $47,150 |

| 22% | $47,151 | $100,525 |

| 24% | $100,526 | $191,950 |

| 32% | $191,951 | $243,725 |

| 35% | $243,726 | $365,600 |

| 37% | $365,601 | And up |

Table 5. Head of Household

| Tax Rate | On Taxable Income From | Up To |

|---|---|---|

| 10% | $0 | $16,550 |

| 12% | $16,551 | $63,100 |

| 22% | $63,101 | $100,500 |

| 24% | $100,501 | $191,950 |

| 32% | $191,951 | $243,700 |

| 35% | $243,701 | $609,350 |

| 37% | $609,351 | And up |

Using the Table

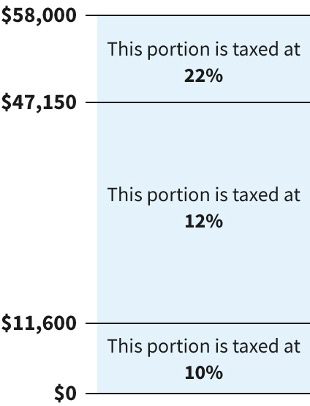

Let’s assume you are a single filer with $58,000 taxable income. In this case, you will use table for single taxpayers. When your income is between $47,151 and $100,525, and your tax bracket is 22 percent. Tax liability is the amount of your taxable income multiplied by your tax rate (Taxable Income x Tax Rate = Tax Liability).

Let’s assume you are a single filer with $58,000 taxable income. In this case, you will use table for single taxpayers. When your income is between $47,151 and $100,525, and your tax bracket is 22 percent. Tax liability is the amount of your taxable income multiplied by your tax rate (Taxable Income x Tax Rate = Tax Liability).

Luckily, you will not pay 22 percent on all $58,000. Instead, you will pay 10 percent on your first $11,600 in income, 12 percent on the next $35,550 ($47,150-$11,600), and finally 22 percent on the remaining$10,850 ($58,000 to $47,150) in taxable income.

While taxes can seem complex, having a solid knowledge of how filing status, taxable income, and tax bracket is an important first step in getting your tax liability right. It is important to remember that of all the money you make—the amount that is taxable and your filing status (whether you are single or married)—help determine your tax bracket. Being in a higher tax bracket does not mean all of your income is taxed at the higher bracket. Instead, different portions of your income are taxed at different rates. By understanding these basics, you can prepare for taxes in advance. You can change the amount of taxes you allow to come directly out of your paycheck for each pay period so that there is no surprise tax bills during tax time at the end of the year.

To learn more about using tax credits and tax deductions to save money on taxes.