Forestry

Learn the difference between additionality and business-as-usual practices in carbon markets. Both are fundamental to all carbon markets or programs.

Additionality

Additionality is an important concept of forest carbon markets. Carbon sequestered and ultimately stored must be additional, beyond some baseline, for a carbon offset to effectively and meaningfully offset greenhouse gas (GHG) emissions. Additionality is the sequestration and storage of carbon resulting directly from a practice conducted because a landowner enrolled in a carbon project to receive compensation for that additional amount of carbon sequestered and stored on the landscape.

Business-As-Usual (BAU) & a Carbon Baseline

A closely related concept is business-as-usual (BAU), which is essentially forest management practices that a particular landowner would conduct if that landowner did not enroll in a forest carbon project. All forests sequester and store carbon, regardless of whether those forests are enrolled in forest carbon offset projects. Under a landowner’s BAU, carbon will be sequestered and stored, their baseline amount of carbon sequestered and stored. When a landowner fails to enroll in a forest carbon offset project, thereby managing their forest consistent with their BAU, there is no incentive to conduct a practice leading to more carbon being sequestered and stored beyond this baseline amount. Here, we provide examples where additional amounts of carbon are sequestered and stored beyond the baseline amount because a landowner enrolled in a carbon offset project, thereby deferring timber harvests and expecting financial compensation in return. The deferment of timber harvests and the associated amounts of additional carbon sequestration and storage occur directly as a result of the landowner enrolling in a forest carbon offset project, thus altering their forest management from their BAU.

Carbon Offset Projects, Registries & Verifiers

The basic concepts of additionality and BAU are fundamental to all carbon offset projects, sometimes referred to as carbon markets or programs. However, projects differ in defined practices, resulting in additional amounts of carbon being sequestered on the landscape due to registries and verification. Within the voluntary carbon market, the parties involved include the landowner, project developer, registries (carbon program or carbon standards), verifier, and buyer. Landowners interested in participating in the voluntary carbon market will decide which project created by developers they would like to follow. Project developers create and source carbon offset projects, working with registries and verifiers to meet required standards, thereby making the project certified for purchase by consumers (buyers) to offset their carbon footprint. The role of registries is to provide a set of standards for carbon projects. including carbon measurement and methodology and review and regulation of the project to ensure that it is certified. The role of verifiers is to inspect a carbon program and check to ensure that it is meeting the set standards. A third party does the verification.

Carbon Credits Versus Carbon Offsets

In this publication, the term carbon credit refers to the amount of carbon emitted by an industry under involuntary, cap-and-trade systems and markets, while the term carbon offsets refers to carbon sequestered elsewhere and traded on a voluntary market. A carbon offset is a way to balance the scales. Forest landowners store carbon in trees, which helps counteract and offset the carbon released by industries (hence the term elsewhere). Unlike the involuntary markets, which enforce a cap on greenhouse gas (GHG) emissions, there are no formal governmental regulations specifying voluntary market participation and activities. Voluntary markets adhere to specific requirements such as registries and verifiers as described in the previous paragraph.

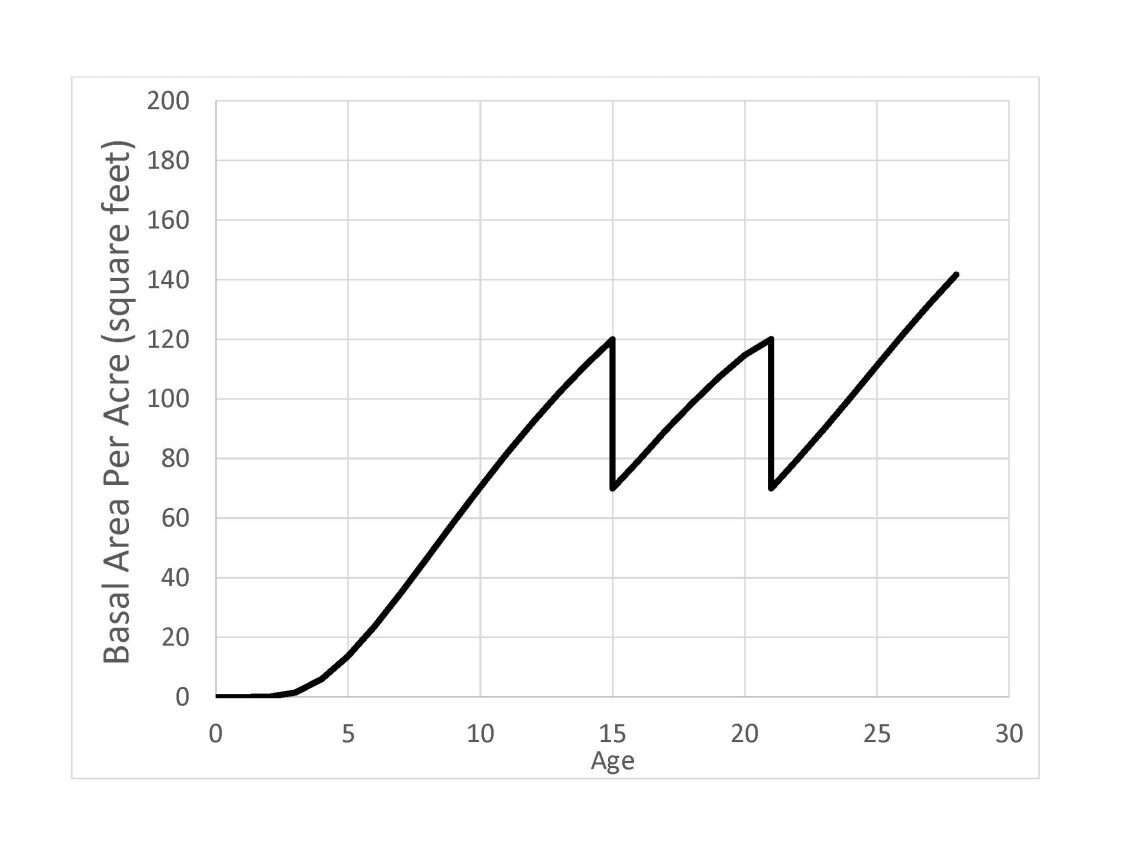

Figure 1

A Specific Type of Offset: Harvest Deferral Credits

Figures 1 through 4 illustrate the concepts of BAU, additionality, and harvest deferral credits (HDC), which are offsets. These are examples of generating carbon offsets annually by deferring harvests for one year; however, these examples can be generalized for any length of harvest deferral. An offset is assigned when a landowner defers a harvest for one year beyond normal harvesting regime if they were not participating in a particular project. Therefore, because BAU is the annual harvesting activities of a landowner if they did not participate in a project, the concept of BAU is extremely important when carbon offsets are assigned based on harvest deferments.

Figure 1.

The depicted basal area trajectory results from what could be considered a typical forest management (silvicultural) regime across a rotation of loblolly pine plantations within the Western Gulf region of the southeastern United States. This management regime could be considered an example of a business- as-usual (BAU) annual harvest activity, a forest management regime when a landowner does not enroll or participate in a particular forest carbon project. A first thinning is conducted at age 15, a second thinning is conducted at age 21, and a final harvest, or clearcut, is conducted at age 28.

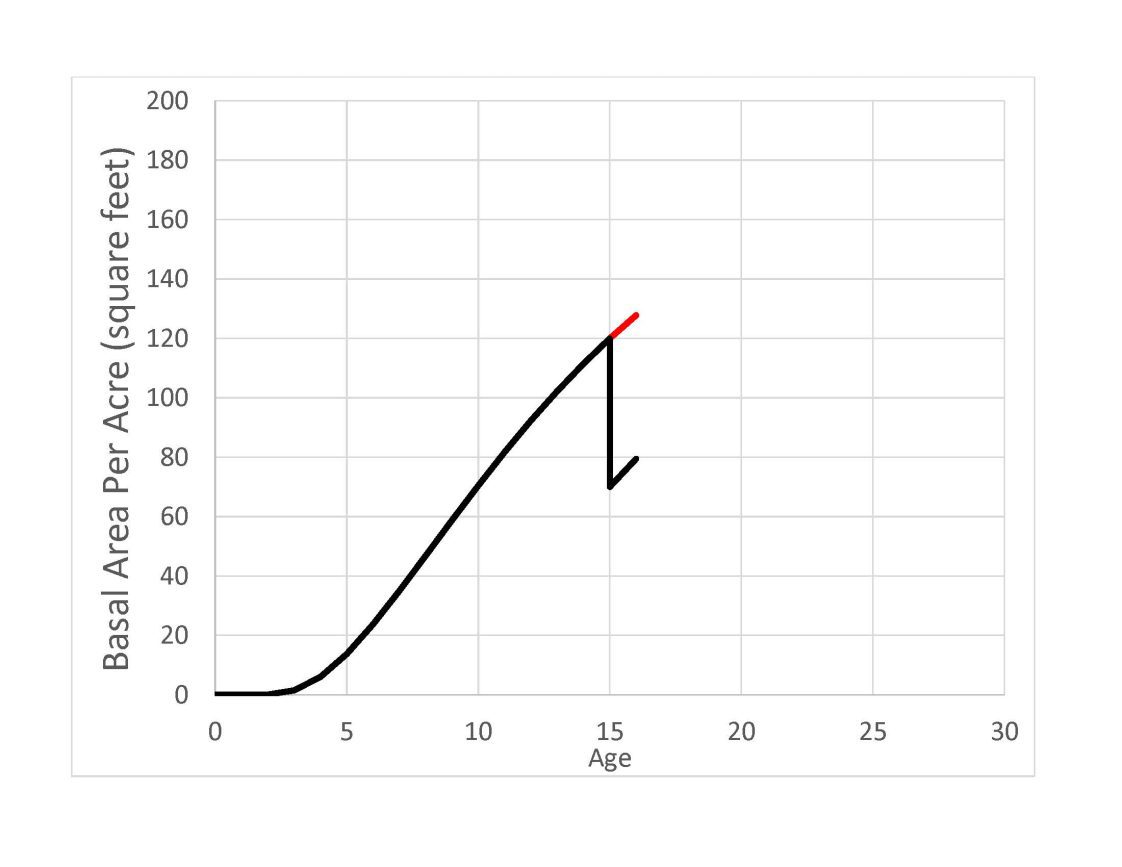

Figure 2

Figure 2.

Assuming the forest management (silvicultural) regime depicted in figure 1 is considered business-as-usual (BAU) for a loblolly pine plantation in the Western Gulf region, a landowner would receive some amount of harvest deferral credit (HDC) if the landowner deferred the first thinning until age 16. This is because under BAU, if a landowner defers this 1st-thinning to age 16, the amount of carbon sequestered would be considered additional, and hence the landowner would receive some amount of HDC and therefore some amount of payment for the carbon sequestered resulting from the additional growth of the UNTHINNED forest relative to a THINNED forest. The additional amount of carbon resulted directly from the landowner enrolling into the project, and then deferring (or delaying for at least one year) the harvest.

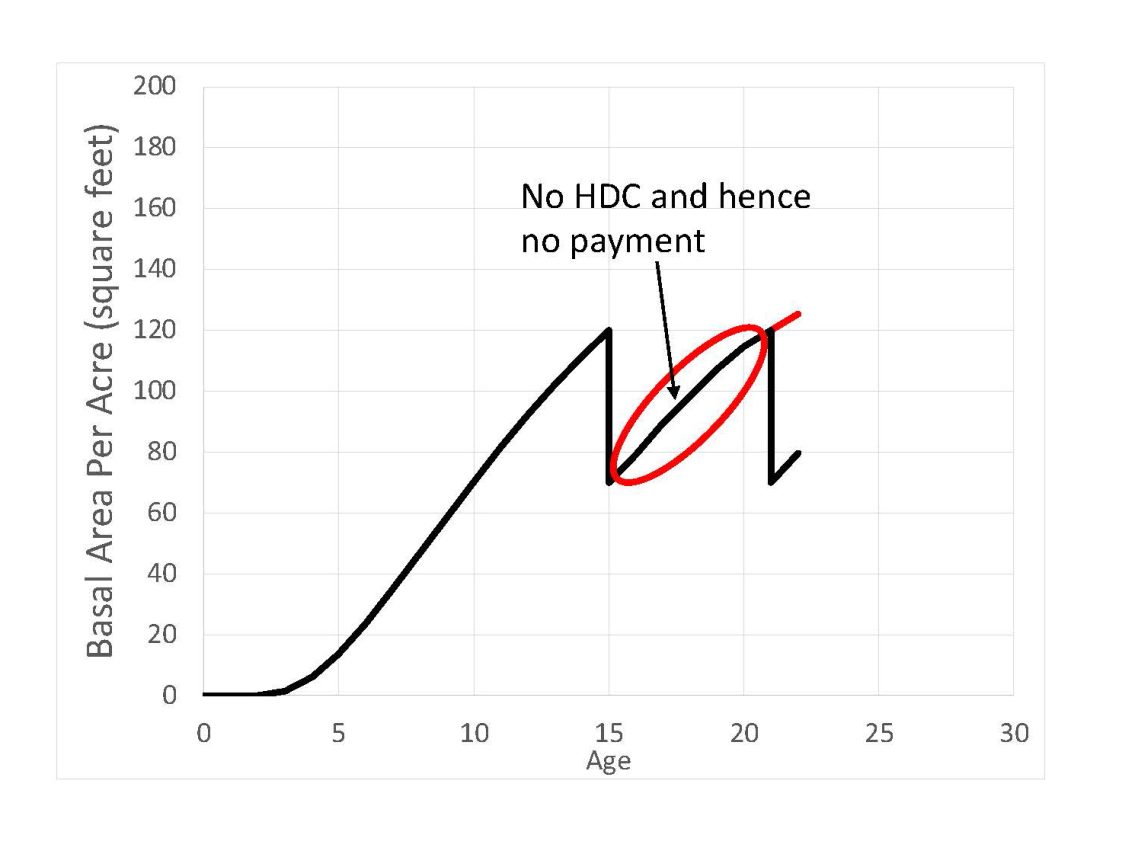

Figure 3.

Assuming the forest management (silvicultural) regime depicted in figure 1 is considered business-as-usual (BAU) for a loblolly pine plantation in the Western Gulf region, a landowner would receive some amount of harvest deferral dredit (HDC) if the landowner deferred the second thinning until age 22. This is because under BAU, if a landowner defers this second thinning to age 22, the amount of carbon sequestered would be considered additional, and the landowner would receive some amount of HDC and, therefore, some amount of payment for the carbon sequestered resulting from the additional growth of the non second- thinned forest relative to a second-thinned forest. The additional amount of carbon resulted directly from the landowner enrolling in the project and then deferring (or delaying for at least 1 year) the harvest. Plantation ages circled in red will result in carbon being sequestered whether a landowner participates in the forest carbon project or not, and hence, the carbon is not additional beyond BAU.

Figure 3

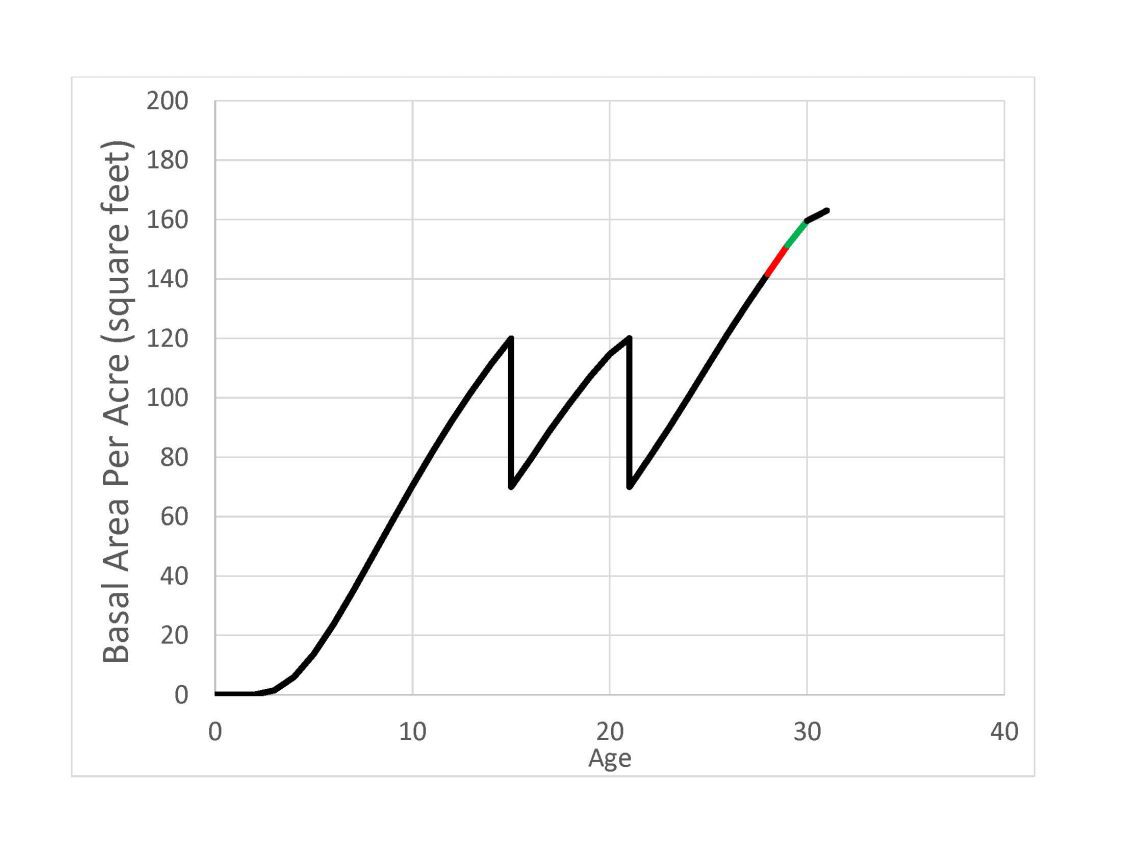

Figure 4.

Assuming the forest management (silvicultural) regime depicted in figure 1 is considered business-as-usual (BAU) for a loblolly pine plantation in the Western Gulf region, a landowner would receive some amount of harvest deferral offset (HDC) if the landowner deferred final harvest until after age 28. This is because under BAU, if a landowner deferred a harvest one, two, three, four years, etc. beyond age 28, the amount of carbon sequestered would be considered additional, and hence the landowner would receive some amount of HDC and, therefore, some amount of payment for the carbon sequestered resulting from the additional growth of the forest. The additional amount of carbon resulted directly from the landowner enrolling in the project and then deferring (or delaying for at least 1 year) the final clearcut harvest.

A Common BAU Activity for Loblolly Pine Plantations in Alabama and Mississippi

Figure 4

Figure 1 shows a common BAU harvesting activity for many loblolly pine plantations in Alabama and Mississippi. Seedlings are planted in year 0, a first thinning is then conducted at age 15 (figure 2), a second thinning is conducted at age 21 (figure 3), and a final harvest—or clearcut—occurs at age 28 (figure 4). This is an example rotation for loblolly pine plantations if a landowner was not participating in a particular forest carbon project; many other rotation schedules are plausible. Despite the landowner not participating in a forest carbon project, this plantation is still sequestering carbon throughout the 28-year rotation. Thus, the amount of carbon sequestered during this rotation can be considered a baseline, the amount of carbon sequestered under BAU. Therefore, any deferred harvest on an annual basis due to the landowner being enrolled in the forest carbon project that results in an additional amount of carbon being sequestered beyond BAU during the next year, should result in some offset. The landowner should receive some offset for deferring their harvest, or HDC, and therefore some financial compensation from the forest carbon project developer. When carbon sequestration beyond a baseline occurs directly from a landowner enrolling in a project and then conducting a practice (e.g., deferring a harvest) because they enrolled in that project, that sequestered carbon is considered additional.

Firstly, notice the word additional: additionality is carbon sequestered beyond BAU practices. Suppose a landowner is going to sequester the same amount of carbon whether they participate in a forest carbon project or not. Why should the project assign any offset to the carbon sequestered? The sequestered carbon does not offset any GHG that would not have been offset without being enrolled in the forest carbon project. Secondly, when carbon offsets are bought and sold based on the deferment of a harvest, an HDC is just that—an offset given to a landowner for deferring a harvest. In this case, a one-year deferral.

Projects that assign offsets based on harvest deferments give carbon offsets to landowners when they defer a harvest, in this case for one year, beyond what their normal harvesting regime would be if they were not participating in the forest carbon project. For each landowner, BAU is assessed each year, or any other carbon project-specific length of deferment, and the landowner is assigned HDCs for any additional amounts of carbon sequestered beyond their annual BAU assessment.

Landowners should realize, though, that their BAU assessments are not just related to the typical behavior of a landowner from a biological or financial perspective, (the optimal planting density), timings of thinnings (figures 2 and 3), residual densities and optimal thinning regimes, the optimal clearcut age (figure 4), and stumpage values. Beyond forestry-related aspects, a BAU typically depends on the landowner’s ability to conduct harvests that are common from a biological or financial perspective. In other words, can a landowner actually thin their forest given their acreage, soil type, road infrastructure, available loggers, markets for mills, etc.? Thus, a landowner’s BAU is also a function of their ability to harvest.

Suppose a landowner enrolled in a forest carbon project should harvest from a biological or financial perspective but cannot because of the lack of logging infrastructure or no available mills to purchase the harvested wood products. In that case, the landowner’s carbon sequestered over the next year is not additional beyond BAU. Whether the landowner enrolls in a forest carbon project or not, the landowner cannot harvest. Therefore, the carbon sequestered over the next year is not additional beyond what would have happened without the forest carbon project; the carbon sequestered is not beyond BAU.

Landowners should realize that forest carbon projects only estimate BAU activity. There is no way for a particular forest carbon project to formally know what your intentions are over the next year. Carbon projects use algorithms largely comprised of mathematical representations, or models, of tree biology and landowner behaviors. These mathematical models are based on theory and assumptions as well as observations of tree biology, human behavior, and market conditions over many previous years. Although the concept seems straightforward, these mathematical representations can be complicated and are often based on several assumptions. All BAU assessments are based on probabilities, thus they are only estimates. Despite this, the amount of HDCs assigned to any landowner are based on these BAU assessments, and the projects have the final say.

Additional Resources

Ollendyke, D. 2023. Understanding Carbon Credits and Offsets. Penn State Extension. The Pennsylvania State University. University Park, PA.

Adam Maggard, Extension Specialist, Associate Professor, Forestry, Wildlife and Environment, Auburn University; and Curtis VanderSchaaf, Forestry Extension Specialist, Assistant Professor, Central Mississippi Research and Extension Center, Mississippi State University

Adam Maggard, Extension Specialist, Associate Professor, Forestry, Wildlife and Environment, Auburn University; and Curtis VanderSchaaf, Forestry Extension Specialist, Assistant Professor, Central Mississippi Research and Extension Center, Mississippi State University

New September 2023, Forest Carbon Market Concepts of Business-as-Usual & Additionality from Harvest Deferment, FOR-2144