Farm Management

Are Alabamians willing to pay more for beer made with locally sourced ingredients? Is there a market for Alabama brewers and farmers? Learn more in this study of Alabama consumers.

Alabama Craft Beer Industry

According to the Brewer’s Association, Alabama’s craft beer industry grew from just six in 2011 to fifty-six in 2023. In 2023, the industry was valued at $704 million, ranking it twenty-ninth among U.S. states.

This increase in the number of Alabama breweries corresponds with piqued consumer interest in locally grown food. Sweet Grown Alabama, a nonprofit that connects consumers and retailers to Alabama-grown agricultural products, indicates that Alabama consumers are willing to pay more for Alabama-grown produce. But is this also the case for beer?

Little is known about Alabama beer consumers’ preferences for local beer. If the trend for local extends to the beer industry, there may be a market for Alabama farmers to produce and sell crops, such as barley and hops, that are used in beer production.

This article uses data from a survey of Alabama beer consumers to explore preferences for beer produced with Alabama-grown ingredients.

Sample of Alabama Consumers

In December 2024, a survey was conducted with 150 Alabama beer consumers to understand their beer consumption patterns, preferences, and spending habits. Data was collected via an online survey, and respondents were recruited from a Qualtrics panel.

The survey investigated respondents’ preferred beer types and styles, as well as their willingness to purchase beer made with locally sourced hops and barley carrying the Sweet Grown Alabama label.

Sweet Grown Alabama was chosen because it is an established and recognized local branding initiative that is familiar to Alabama consumers, including more than two-thirds of the survey respondents.

Our sample, representing the Alabama beer-drinking population, was 57 percent male, which is higher than the statewide value. Most were individuals 35 years and older, which is partly by design as respondents were required to be at least 21 years of age. Respondents had a higher educational attainment on average than the general population. The sample tended to overrepresent middle- and upper-middle-income groups, which may also be due to the older age recruited.

What Beer Is Considered Local?

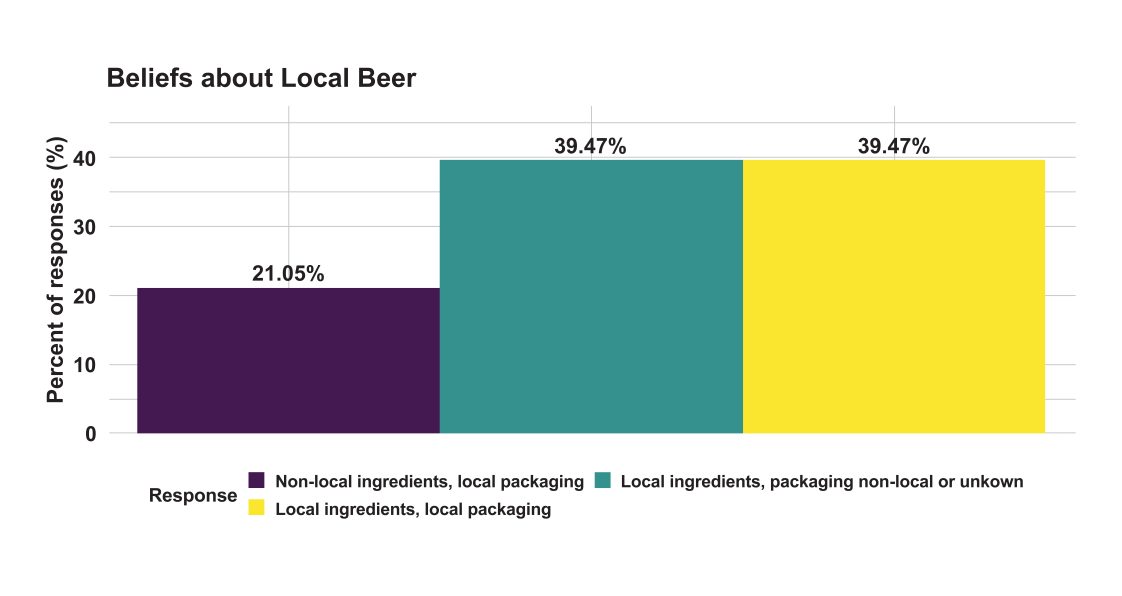

Respondents overwhelmingly believed that a local beer must be made with local ingredients. Only 21 percent believed that a beer with nonlocal ingredients could be considered local. A total of 39.47 percent of respondents associated local beer with locally sourced ingredients and local packaging; an equal percentage associated local beer with local ingredients but not with local packaging. These results suggest that packaging location may play a lesser role in public perceptions of being local. More notably, many Alabama craft beers—despite being brewed locally—may not qualify as local in the eyes of most consumers, since key ingredients like hops and barley are often sourced from outside the state. This perception gap highlights the importance of transparent sourcing and may present opportunities for breweries to invest in or support development of local ingredient supply chains.

Figure 1. What Alabama beer consumers consider to be local beer

Willingness to Pay for Alabama-Sourced Beer

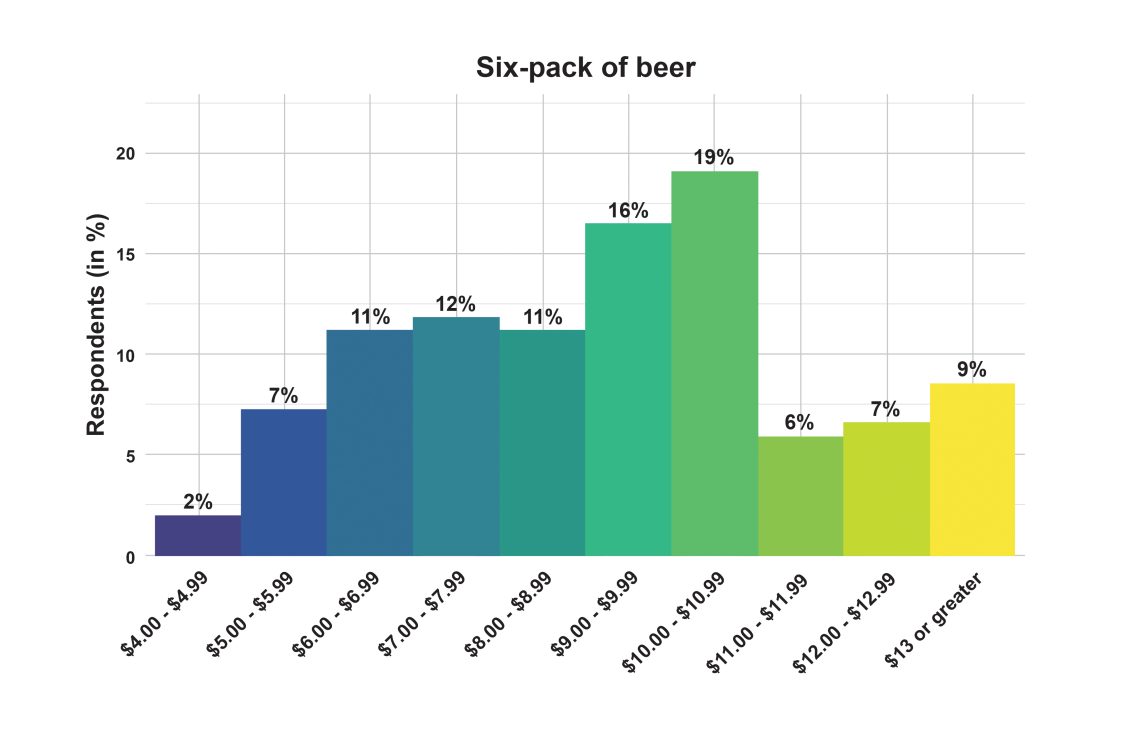

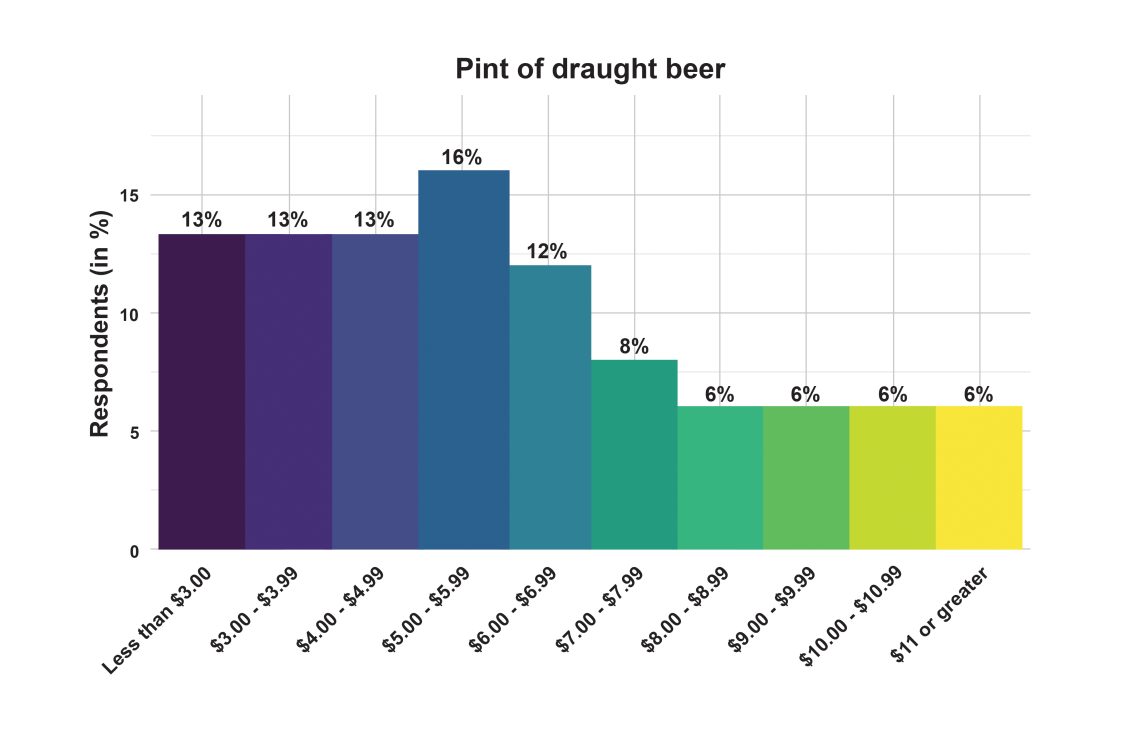

Survey respondents first stated how much they typically spend on their “go-to” beer, served as (1) a six-pack of 12-ounce bottles purchased from a retailer and (2) as a draught pint from a bar, brewery, or restaurant. As shown in figures 2 and 3, the median respondent typically spent $9.50 per six-pack and $5.50 per pint of draught beer. Respondents showed more variation in their typical price paid for draught beer, as the average price was $6.39, skewed by higher values. Compared to respondents from other states, Alabama respondents indicated they paid less for bottled beer but more for draught pints.

Figure 2. Respondents’ typical amount paid for a six-pack of their go-to beer

Figure 3. Respondents’ typical amount paid for a draught pint of their go-to beer

Respondents then answered how much they would pay for their go-to beer if ingredients were sourced in Alabama. Respondents were provided with different choice scenarios, where barley, hops, or both barley and hops were sourced in Alabama (table 1).

Table 1: Premium for Alabama-Grown Beer by Serving Style and Ingredient Sourcing

| Serving Style | Ingredient Sourcing | Premium (in $) | Premium (%) |

|---|---|---|---|

| Six-pack (12-oz. bottles) | Alabama-grown hops | 1.04 | 10.78 |

| Six-pack (12-oz. bottles) | Alabama-grown barley | 1.06 | 11.06 |

| Six-pack (12-oz. bottles) | Alabama-grown hops and barley | 1.07 | 11.09 |

| Draught (pint) | Alabama-grown hops | 0.83 | 13.01 |

| Draught (pint) | Alabama-grown barley | 0.90 | 14.11 |

| Draught (pint) | Alabama-grown hops and barley | 0.92 | 14.44 |

For bottled beer, respondents indicated they would pay an additional $1.04 per six-pack of beer made with Alabama-grown hops, or a 10.78 percent premium. The premium was similar at $1.06 per six-pack for beer made with Alabama-grown barley and $1.07 for beer made with Alabama-grown barley and hops. Respondents exhibited a similar pattern for draught beer, placing a $0.90-per-pint premium on beer made with Alabama-grown barley. The premium for locally sourced ingredients was higher for draught beer, ranging from 13 to 14 percent compared to around 11 percent for six-packs.

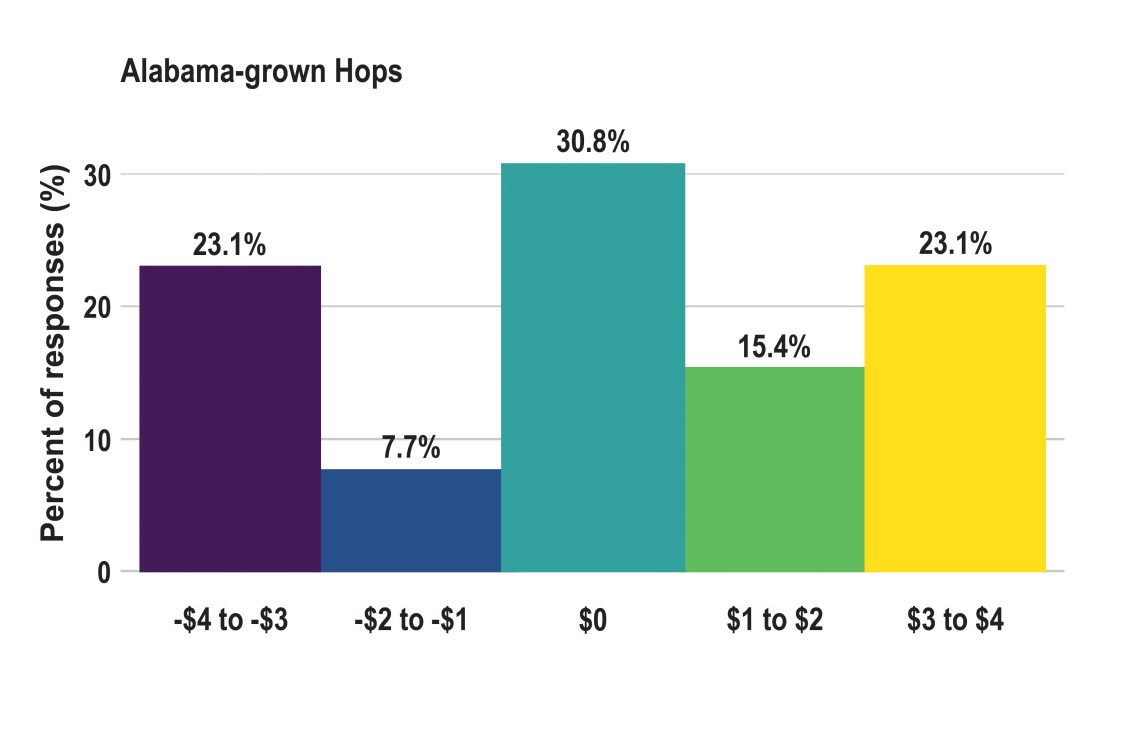

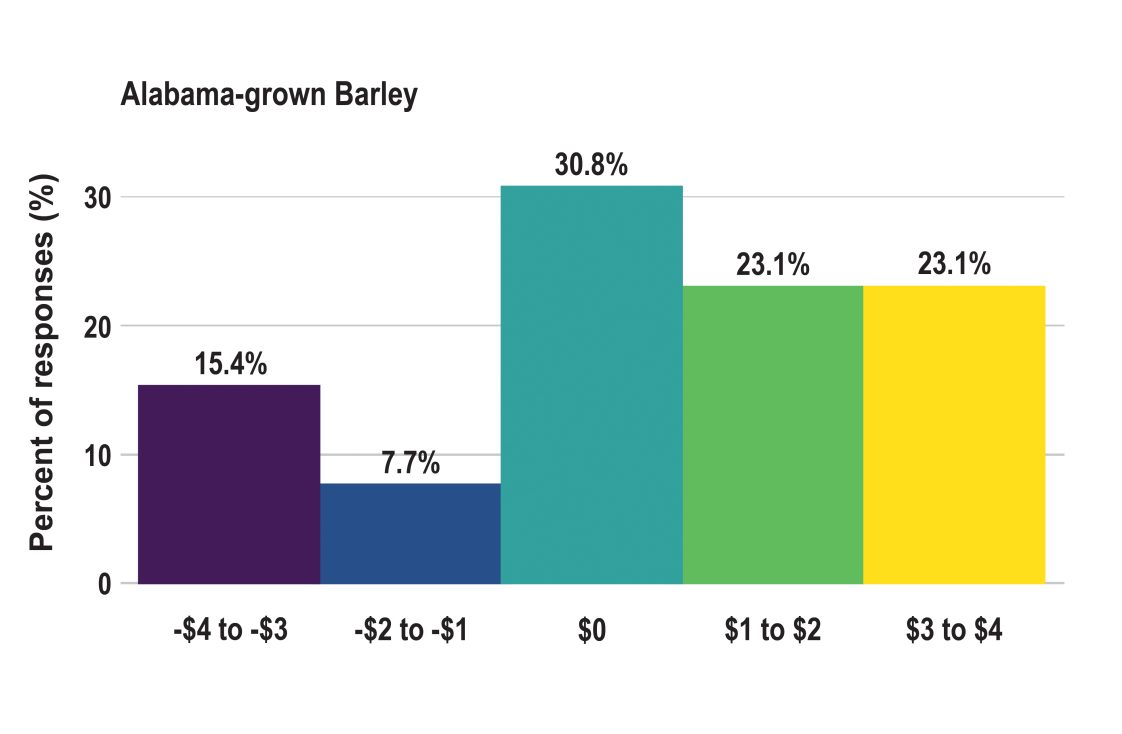

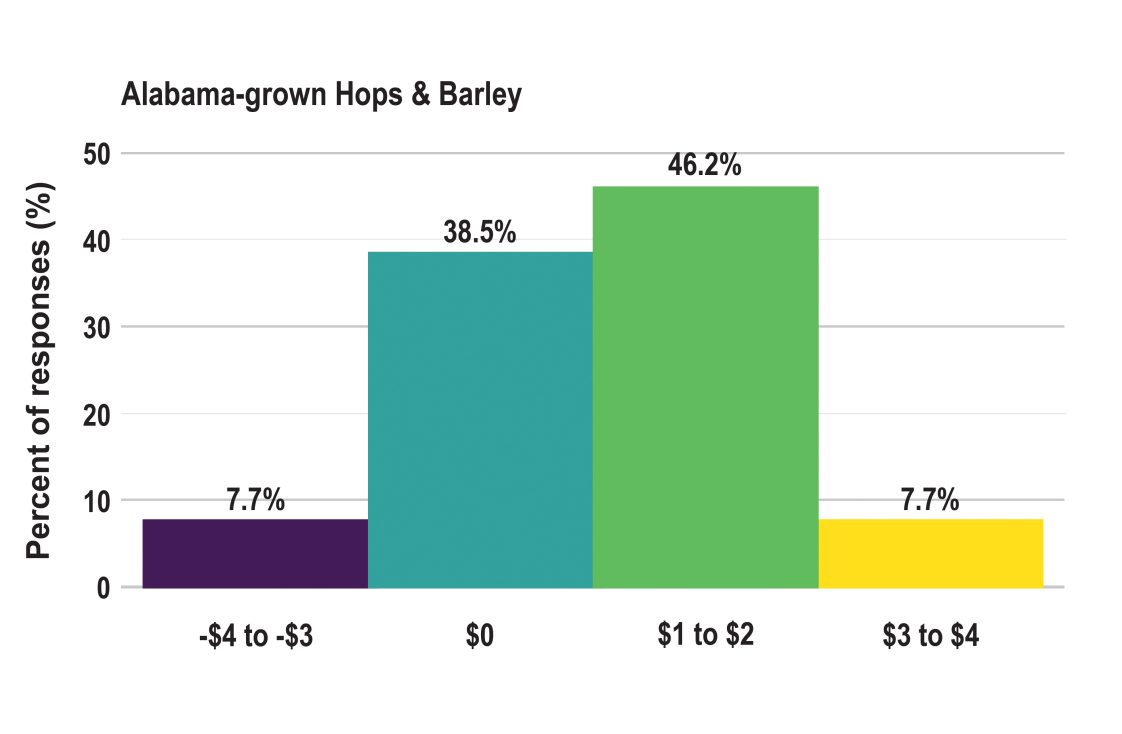

While Alabama consumers indicated they would pay a statistically significantly higher price for beer made with either Alabama-grown barley or hops, there was no additional premium for having both Alabama-grown barley and hops. It is also important to note that there was considerable variation in the premium amount across individuals, and some respondents (approximately 20 percent) required a discount to purchase Alabama-grown beer. As shown in figure 4, not all consumers perceived added value in locally sourced ingredients. More than 30 percent indicated a willingness to pay equal to $0, reflecting neutrality toward local sourcing. This behavior could be due, in part, to uncertainty in the quality of local ingredients used in craft beer.

Figure 4. Alabama beer consumers’ premium for a six-pack of Alabama-grown beer by ingredient sourcing — Alabama-Grown Hops

Figure 4. Alabama beer consumers’ premium for a six-pack of Alabama-grown beer by ingredient sourcing — Alabama-Grown Barley

Figure 4. Alabama beer consumers’ premium for a six-pack of Alabama-grown beer by ingredient sourcing — Alabama-Grown Hops & Barley

Conclusions

Alabama respondents indicated they are willing to pay a premium for beer made with Alabama-grown ingredients sourced from a Sweet Grown Alabama farm. Consumers stated they were willing to pay around $1 more for a six-pack of beer made with Alabama-grown barley, Alabama-grown hops, or Alabama-grown barley and hops. The premium amounted to around $0.90 more for a pint of draught beer made with Alabama-grown barley, Alabama-grown hops, or Alabama-grown barley and hops. Interestingly, consumers were not willing to pay more if both hops and barley were Alabamagrown versus if just one of the two ingredients was Alabama grown.

These results indicate there may be opportunities for breweries to obtain a premium for beer marketed as made with Alabama-grown ingredients or branded with the Sweet Grown Alabama label. However, because these values were obtained through a survey of potential craft beer consumers, they should be interpreted as upper-bound estimates of what consumers might be willing to pay in an actual purchase situation.

References

- Brewers Association. 2024. “Alabama’s Craft Beer Sales and Production Statistics, 2023.” State Stats (blog).

- Holley, J., J. Duke, W. Sawadgo, S. Huseynov, A. Rabinowitz, and J. Garcia Gamez. “Consumer Willingness to Pay for Sweet Grown Alabama Sweet Potatoes.” Alabama Cooperative Extension System.

- Staples, A. J., T. Malone, and J. R. Sirrine. 2021. “Hopping on the localness craze: What brewers want from state-grown hops.” Managerial and Decision Economics 42(2), 463–473.

Pathmanathan Sivashankar, Graduate Research Assistant; Wendiam Sawadgo, Extension Economist, Assistant Professor; and Samir Huseynov, Assistant Professor; all in Agricultural Economics and Rural Sociology, Auburn University

Pathmanathan Sivashankar, Graduate Research Assistant; Wendiam Sawadgo, Extension Economist, Assistant Professor; and Samir Huseynov, Assistant Professor; all in Agricultural Economics and Rural Sociology, Auburn University

New September 2025, Consumer Willingness to Pay More for Beer Made with Alabama-Grown Ingredients, ANR-3179