Farm Management

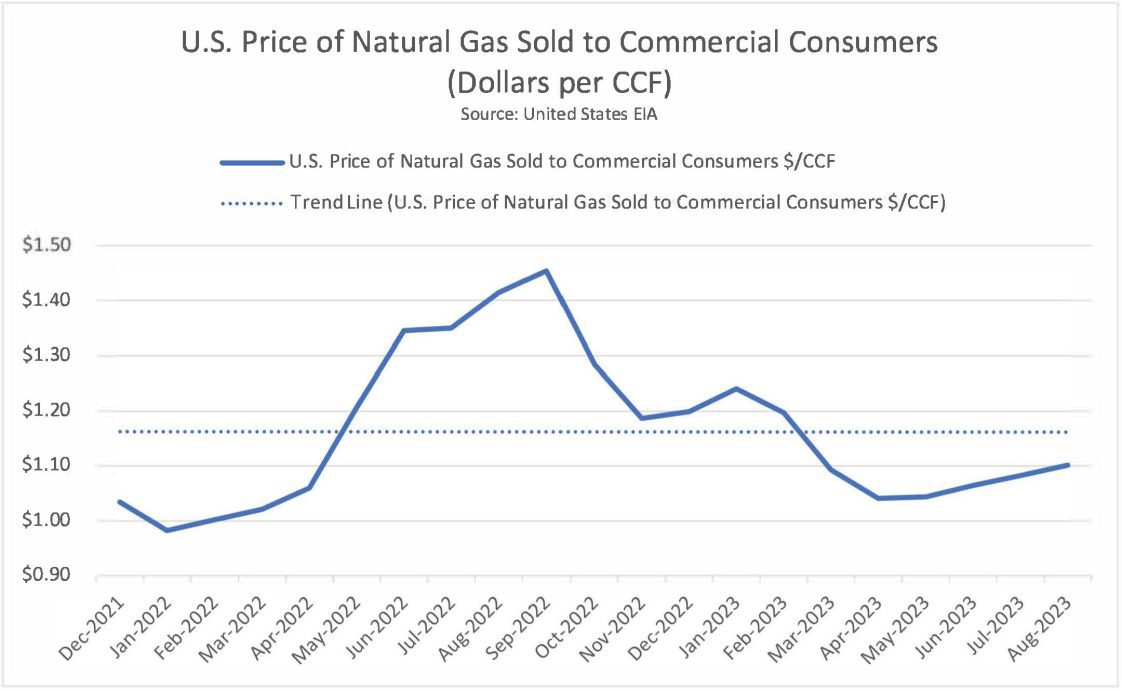

Figure 1a. Natural gas prices have been volatile recently in response to international events and trading. However, long-term forecasts are lower than the high prices of 2022. US production looks to be strong and increasing over time.

As winter approaches the broiler belt, it brings with it increased heating fuel bills for poultry growers. Most modern poultry houses in the Southeast use liquified propane (LP) or natural gas (NG) to keep birds warm during the winter, as well as during brood phases year-round. In many areas of the Southeast, growers can choose one fuel over the other. However, this is a long-term choice that requires equipment conversions and plumbing changes. The cost of heating poultry houses is usually a primary driver of this choice.

Effects on Prices

LP and NG prices have proven to be volatile at times. Historically, LP price lags — but roughly follows — crude oil price changes, as it is a byproduct of crude oil production. NG prices also have a crude oil production component but react more to international events and trading. The development of domestic gas fracking has made it more available and advanced NG as a competitor to LP in the US. However, access to NG pipelines is a limiting factor for many poultry producers. Also, NG customers generally do not have the ability to lower costs via prepurchase agreements, volume purchases, or other negotiated price strategies that LP users have. Natural gas users simply pay the provider’s price at the time of billing. LP users must monitor fuel stocks and schedule deliveries to maintain adequate supplies at the farm. NG users do not have this worry, as they always have pipeline access to gas. Hence, there is also no storage cost to consider with using NG. Farm trials have shown that if NG is readily available and prices are at their normal comparative levels, it is generally less costly to heat a poultry house with NG. But with recent NG price volatility, this could vary.

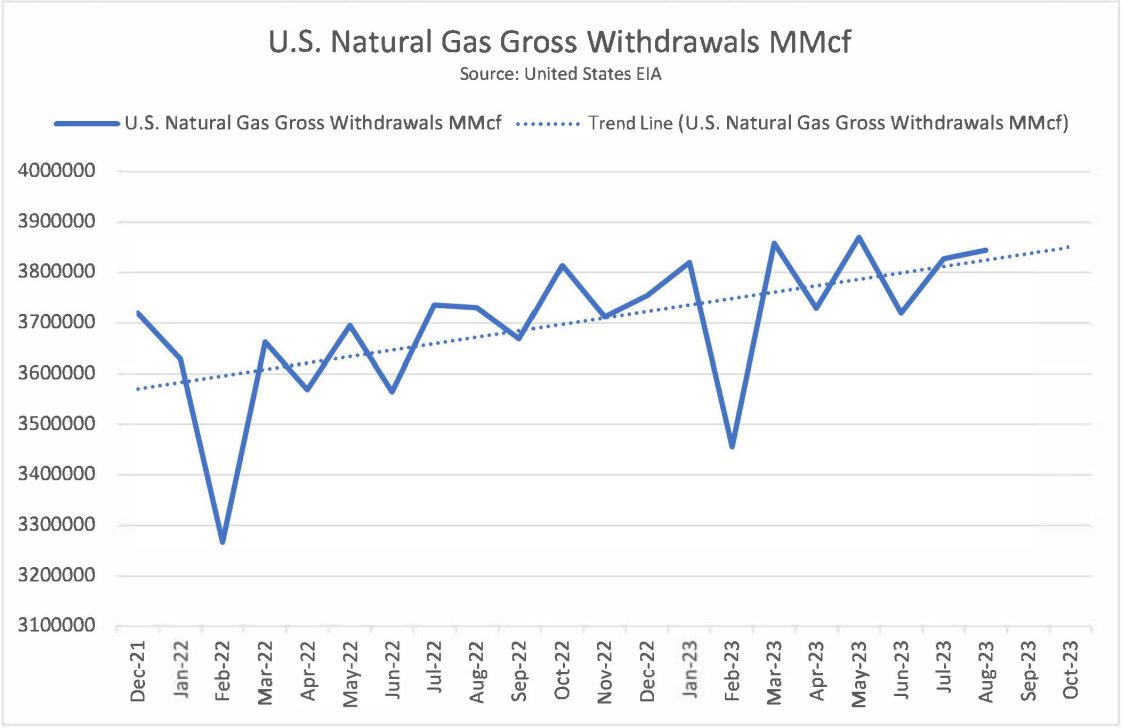

Figure 1b. Natural gas prices have been volatile recently in response to international events and trading. However, long-term forecasts are lower than the high prices of 2022. US production looks to be strong and increasing over time.

LP Costs versus NP Costs

When comparing the costs of these two fuels, it is important to compare them on an equal basis in terms of heat energy output per unit. For this, British Thermal Units (btu) per unit is used. One btu is roughly equivalent to the heat of a single matchstick flame. LP is traded and sold to growers by the liquefied gallon and contains approximately 91,452 btu per gallon, with slight variations in actual product delivered. NG is traded and reported on in 1,000 cubic feet (MCF) units, which equals 1 million btu. It is often sold to retail customers by the therm or CCF (100 cubic feet), which is 100,000 btu of energy.

For a quick comparison, you can take the LP price, multiply it by 1.093, and get the rough equivalent price of NG on a per btu basis. For example, if NG is priced at $1.17/CCF or $11.70/MCF (current trend price in figure 1a), LP would need to be priced at approximately $1.07 per gallon to be equal in cost per btu. LP has not been at that low of a price in the Southeast in recent history. Conversely, $1.20/gallon LP (trend forecast price in figure 2a) is roughly equal to $1.31/CCF natural gas.

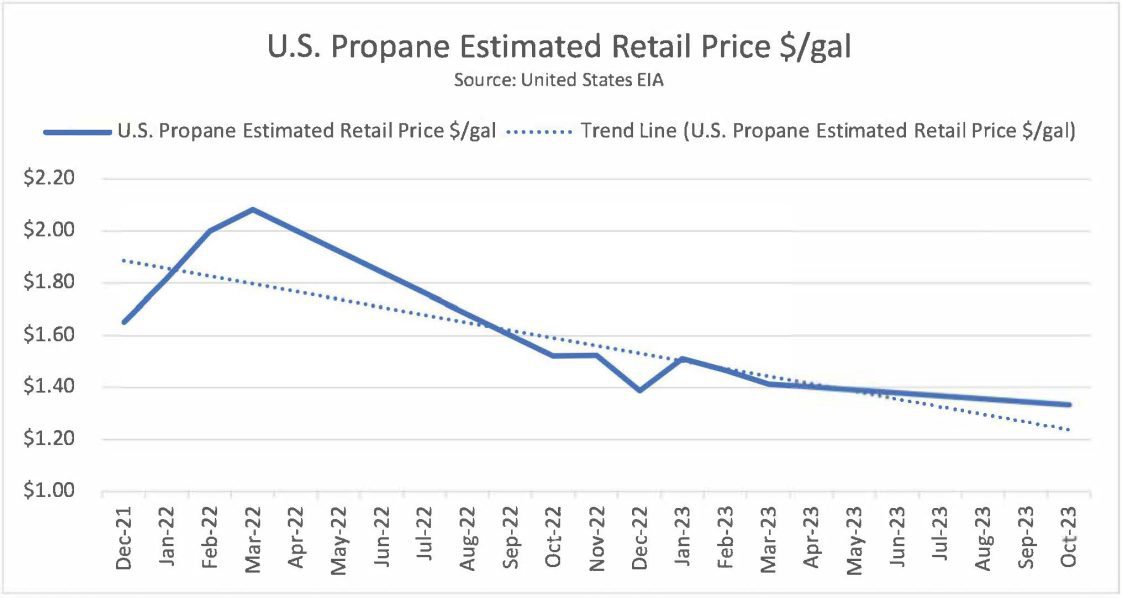

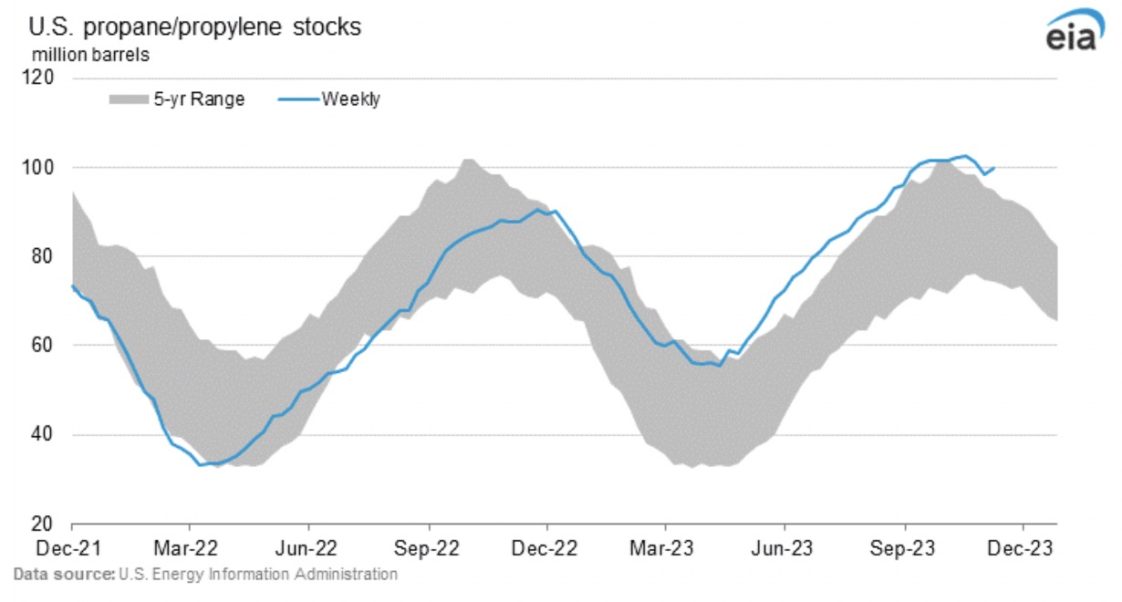

Figure 2a. US stocks of LP are currently strong, suggesting a lower price outlook for US poultry growers for the winter of 2024.

Recent history shows that NG prices are trending below that level, but from the spring of 2022 to the spring of 2023, prices were well above the trend, with commercial rates hitting a high of $1.45/CCF in September 2023. LP prices at that time were approximately $1.52/gal, calculating to a NG equivalent price of $1.66/CCF. These were the national averages; some users may have paid higher local rates for either fuel. Some local providers have varying rates for farms versus residential or commercial for LP or NG. Although NG has generally stayed on the less expensive side of this relationship, it may not always be the case for a specific farm or specific providers.

When looking at these variations, it is important to note that LP prices tend to react more to locally occurring events like weather and the short-term impacts of those events on supply than NG. However, the overall US supply of propane does affect the market prices nationwide as seen in the figures 2a and 2b. Luckily for poultry growers using LP, the current US supply is strong and suggests lower winter prices are possible this year. NG is widely traded internationally, and prices are more reactive to international events like the war in Ukraine or Chinese economic strength and purchasing of the commodity. Even so, NG prices are forecasted to remain soft for the coming winter, as US production looks to be strong and growing (figure 1b). Overall, with propane stocks high and natural gas production strong, US poultry growers may be getting a welcome relief this winter from the high fuel costs of recent years, no matter which fuel source they choose.

Figure 2b. US stocks of LP are currently strong, suggesting a lower price outlook for US poultry growers for the winter of 2024. Note: “Estimated Price” was reached by adding $0.40/gal for retail margin to EIA posted wholesale prices. Addition delivery fees was not considered.

Note

Any poultry grower considering making a switch from one heating fuel source to another needs to consider all costs, both short and long term, like equipment changes, plumbing upgrades, and pricing flexibility. For detailed information on NG conversion in poultry houses, see Converting to Natural Gas: A Practical Guide, available on the Auburn University Poultry Ventilation and Housing website, ssl.acesag.auburn.edu/poultryventilation/.