Farm Management

Behind Easter, Thanksgiving and Christmas are next largest drivers of demand for table eggs in the United States. Egg prices typically go up in response to this higher demand, and odds are that consumers can expect this to remain true this holiday season.

Rise and Fall of Prices

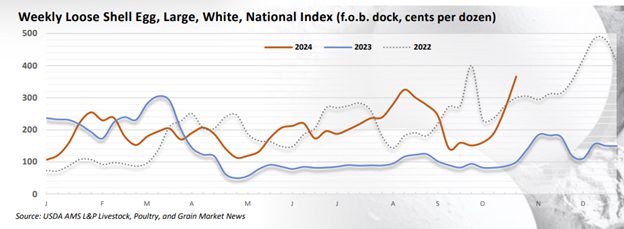

Figure 1. While higher than last year, egg prices were relatively stable in 2024 until mid-summer, when they spiked because of laying-hen losses that occurred earlier in the year. Prices spiked again this fall because of a combination of additional hen losses to Highly Pathogenic Avian Influenza and the increasing demand for the holidays.

Following record-high egg prices in 2022, an increase in the number of laying hens brought a large decrease in 2023 egg prices. Then, beginning in the early summer of 2024, egg prices rose above and remained higher than the 2023 prices. There was also a price spike in August 2024 because of a lower egg supply. This supply was caused by a loss in laying hens from Highly Pathogenic Avian Influenza (HPAI) earlier in the year. Prices then dropped as flocks were repopulated and late-summer demand fell.

Now, leading up to the holiday season, egg prices are spiking again and are higher than they were at the same time in 2022. It was later in 2022 when wholesale egg prices reached an all-time high, approaching five dollars per dozen (figure 1). When you compare the 2022 and 2024 factors that can impact egg prices—namely egg and laying-hen inventories—you see a haunting premonition of where egg prices could be headed this holiday season. In 2024, the holiday demand will be coupled with a decrease in both eggs and laying hens, the same thing that consumers saw in 2022.

Current Factors and Prices

The current inventory of shell eggs and laying hens have dropped 13.7 and 3 percent, respectively, from the previous year, while the egg price is more than 300 percent higher. The current price is also 22 percent higher than the price was at the same time in 2022, when the egg and laying-hen inventories were similar to current inventories (table 1). This situation certainly makes it possible to see the same prices as in 2022. The unknown is demand. If the demand for eggs increases as expected, that would act as an additional driver to the price. However, the inflation of all other food prices could serve to stifle demand, as consumers may not purchase as much overall at the grocery store as in past years.

Table 1. Weekly Shell Egg Inventory, USDA-AMS

Another consideration is the specter of HPAI looming over the layer industry. HPAI losses are driving the current low inventories of laying hens and eggs. In October 2024, 2.84 million layers were lost to HPAI to begin the holiday season. Year-to-date, the layer industry has lost 20.75 million layers, which equals 6.8 percent of the total current flock of producing hens. It is difficult for laying-hen producers to keep up with even the current demand in the face of such losses. Also, the fall waterfowl migration is ramping up, bringing with it an increased HPAI risk. According to the Weekly Shell Egg Demand Indicator from the US Department of Agriculture’s Agricultural Marketing Service, there are currently only 4.1 days of shell eggs on hand for sale. Therefore, any additional hen losses could significantly impact the market. Whether 2024 prices will reach the highs of 2022 remains to be seen. However, if HPAI continues to devastate laying-hen flocks, egg inventories stay low, and the demand for eggs stays strong, prices this year could reach and even surpass 2022 prices.