Agronomic Crops

As we near the end of August, harvest for most row crops is just around the corner. So far, it has been a turbulent year of crop prices, with fewer ups than downs. Several macroeconomic factors including inflation and high interest rates have presented a challenge to producers in 2023. Approaching harvest, the largest remaining question regards what crop production will be, as this will affect crop prices for the coming marketing year. Current drought and its effect on this year’s crop yield is one major factor to watch out for over the next few months.

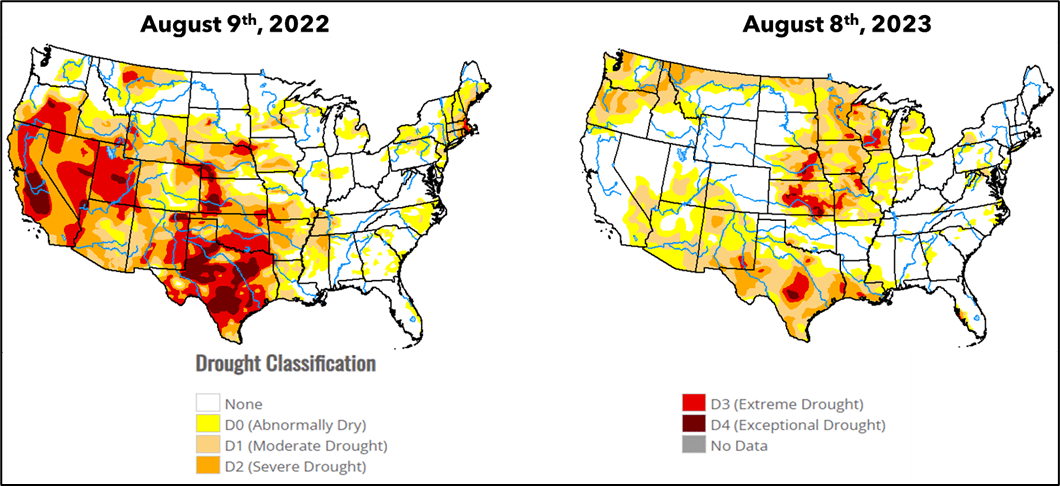

Figure 1: US Drought Monitor Map in 2022 vs. 2023 (Source: https://droughtmonitor.unl.edu/)

Cotton

Cotton planted acreage is down 20% compared to 2022, likely driven by the lower prices at planting time this year. Alabama planted 360 thousand acres to cotton in 2023, a 13% decrease from last year, according to the USDA June Acreage Report. Cotton is in a slightly better situation compared to last year in terms of drought (Figure 1). In 2022, only 54% of the crop was harvested nationwide. Texas – the largest producing cotton state – only harvested a quarter of its planted cotton acreage due to the exceptional drought. In recent years, the percentage of planted cotton acreage that is harvested has fluctuated year-to-year, bouncing from 68% in 2020, to 91% in 2021, and back down to the aforementioned 54% in 2022. The big remaining question is what yield will be and how much cotton acreage will be harvested.

The most recent USDA World Agricultural Supply and Demand Estimates report forecast this year’s cotton yield at just 779 lb. per acre, with 78% of planted acreage expected to be harvested. Overall, this would imply 14.0 million bales of cotton production, which would mark a 3% decline from last year. This decreased production is a result of the combined lower planted acres and lower yields. As a result of the lower-than-expected production, the USDA increased its prediction for the 2023-2024 marketing year average price from 76 cents to 79 cents per lb.

Peanuts

Peanut acreage is estimated to be up 9% compared to last year. Alabama is projected to harvest 167 thousand peanut acres, which would be second only to Georgia. This sizeable peanut acreage follows a year of strong peanut contracts, which resulted in a ten-year high average price received by farmers of $540/ton over the 2022/2023 marketing year, which would be the highest mark in a decade. Yield is forecast at 4,047 lb. per acre, just about equal to last year. Alabama reflects this national trend, with 2023 yield projected to equal last year’s 3,450 lb. per acre.

On the demand side, peanut use for food remains strong, boosted by a 5% increase in peanuts used for peanut butter. This is important because peanut butter makes up around 60% of the peanuts used for food. Overall, even with the strong expected production, sustained peanut demand is expected to keep peanut stocks from increasing above the 1.1-million-ton mark at the end of the 2023/2024 marketing year, which should prevent peanut prices from declining this coming year.

Grain Crops

The Midwest, which dominates grain production in the US, has been affected by drought this year. Whereas last year it was the Great Plains that was in severe drought, this year it is largely the upper Midwest. Areas currently affected by drought include the top-producing corn and soybean states of Iowa, Illinois, Nebraska, and Kansas (Figure 1). In total, an area responsible for 42% of corn production was under drought as of August 15, 2023. Similarly, 38% of soybean production was under drought over that period.

Corn acreage increased by 6 million acres nationwide this year, including a 60 thousand acre jump in Alabama. Thus, we are likely to see a sizable increase in corn production, even amid the drought in the Midwest. In Alabama, corn yields are predicted to increase by 41 bushels per acre relative to 2022, to 159 bushels per acre. Despite increased corn demand, the strong production is likely to increase corn stocks and drive prices downwards. On the other hand, soybean acreage is down 4 million acres nationwide. Alabama is the only state that saw more than a 10% increase in acreage from 2022, with 400 thousand soybean acres planted in 2023. Despite the lowered US soybean production, prices are forecast to decrease due to large production worldwide that would increase global soybean stocks.

Conclusions

With drought becoming a potential challenge for corn and soybean producers in the Midwest, uncertainty remains as to where prices will end up. However, after three years of increasing prices, the USDA projects crop prices to decrease for the 2023/2024 marketing year (Table 1).

Table 1: Past and Projected Crop Prices

| Crop | 2021/2022 | 2022/2023 Estimated | 2023/2024 Projected | August 16, 2023 Closing Price |

|---|---|---|---|---|

| Cotton ($/cwt) | 91.4 | 82.0 | 79.0 | 84.72 Dec 23 |

| Peanuts ($/ton) | 486 | 540 | 540 | NA |

| Soybeans ($/bu) | 13.30 | 14.40 | 12.70 | 13.23 Nov 23 |

| Corn ($/bu) | 6.00 | 6.60 | 4.90 | 4.69 Sep 23 |

As crop prices fall and profit margins tighten, it will be even more crucial to develop a marketing plan and maximize prices received for crops. For more information on marketing tools available to row-crop producers, an online course is available on the Alabama Cooperative Extension System website: https://aces.catalog.auburn.edu/courses/marketing-tools-for-row-crop-producers