Fish & Water

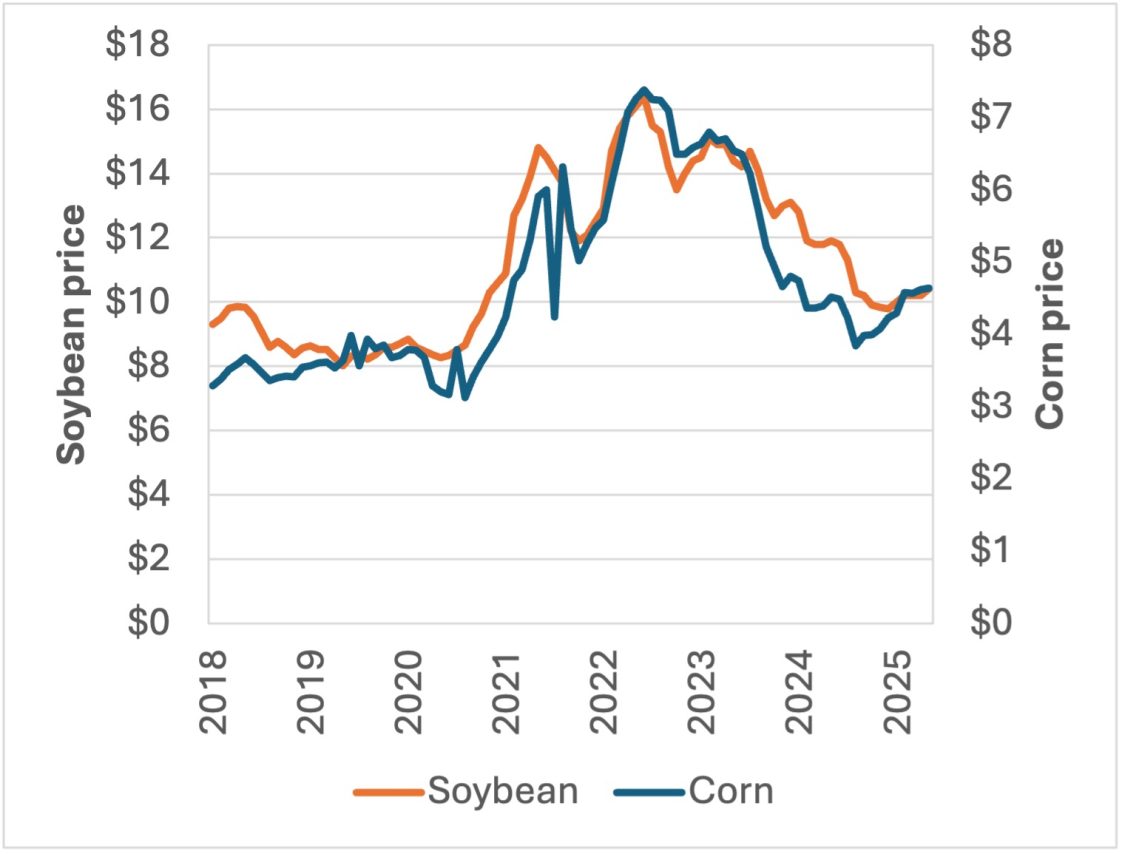

Fish feed typically makes up 50 to 60 percent of aquaculture production costs. In the catfish industry, soybean and corn are the primary feed ingredients and feed prices are highly dependent on these commodity markets. Decreased supplies of corn and soybeans from 2020 to 2023 led to an increase in the price of corn and soybeans and subsequently resulted in high catfish feed prices. Catfish feed prices peaked in early 2023 at nearly $600 per ton for 32 percent protein feed. Since then, feed prices have fallen nearly 25 percent, largely mirroring the decline in prices for corn and soybeans (figure 1).

Figure 1. Farm-level price of soybeans and corn in dollars per bushel (Source: USDA-NASS)

Ending Stock and Price Projections

Ending stocks are projected inventories of commodities and reflect the interplay between supply and demand. High ending stocks suggest excess supply over demand, which typically leads to lower prices received for the commodity. On the other hand, low ending stocks signal scarcity and yield higher prices received.

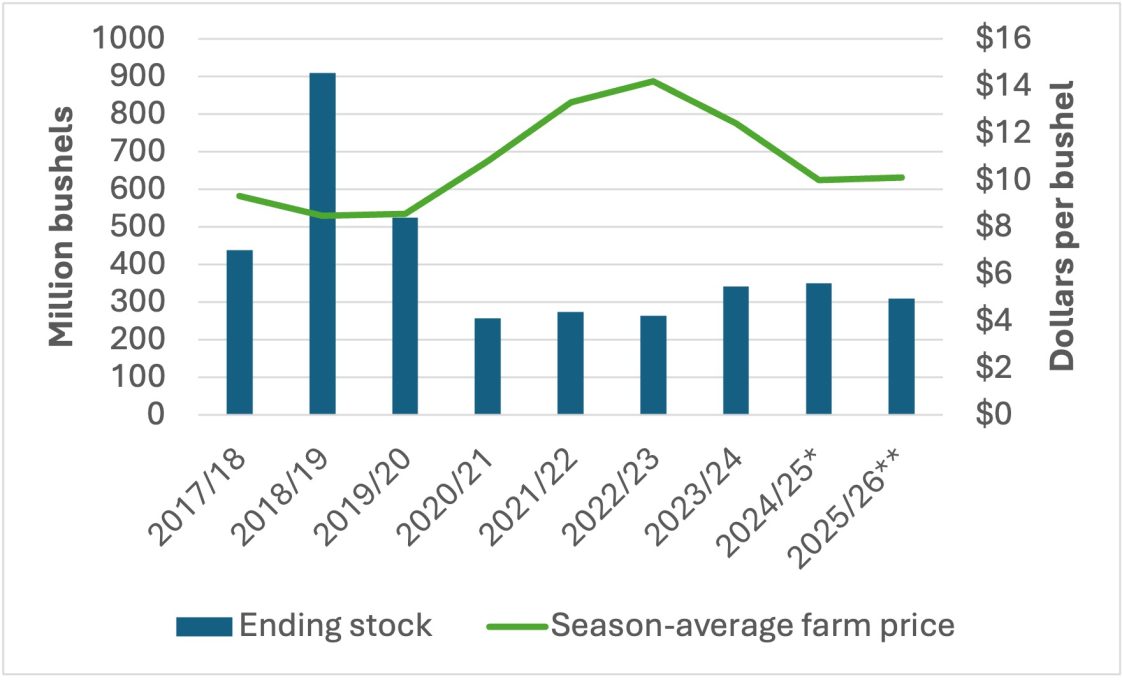

The US Department of Agriculture’s (USDA) most recent World Agricultural Supply and Demand Estimates (WASDE) report projects soybean ending stocks of 310 million bushels in the 2025-26 marketing year (September 1, 2025 to August 31, 2026), which is an 11 percent decline from the previous marketing year, but similar to the short-run average (figure 2). This is largely due to a 3.7 million acre decline in planted soybean area across the United States. An average soybean price of $10.10 per bushel is projected for the 2025-26 marketing year, which is $0.10 higher than 2024-25 price but $2.30 lower than the 2023-24 price and lower than the long-run average. While current soybean crop conditions appear decent, the weather conditions for late July and August will determine final soybean yields and could shift inventory and price projections.

Figure 2. Ending stock of soybean and average farm price per marketing year, September 1 to August 31 (Source: WASDE, 2025) *Estimated **Projected

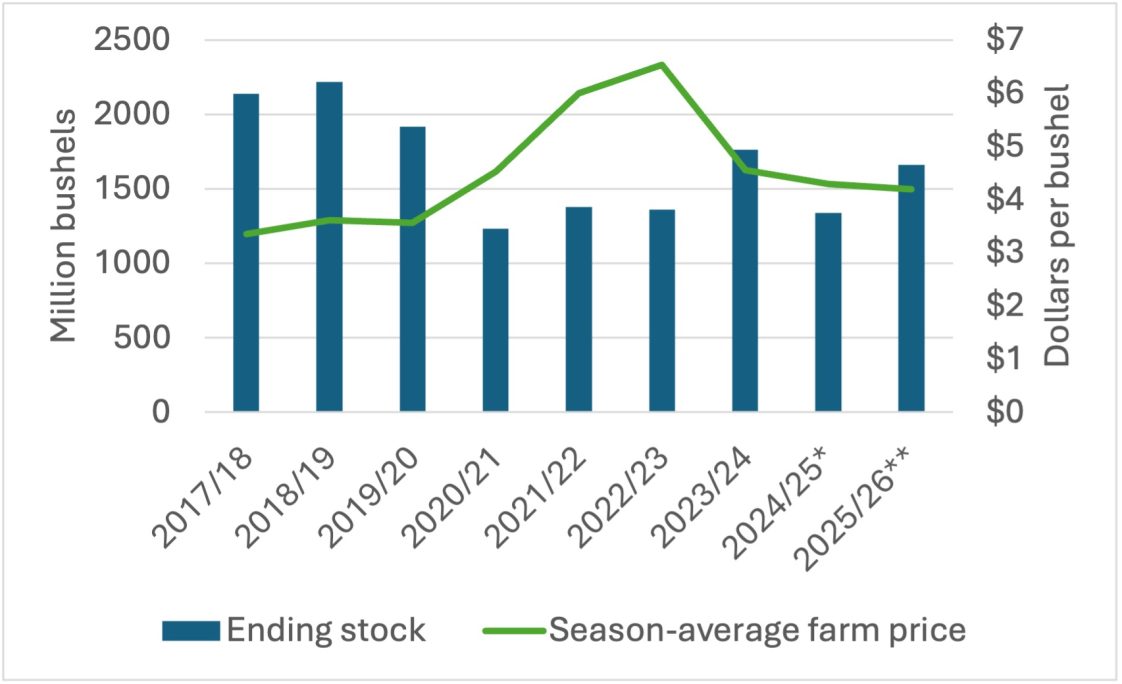

The ending stock projection of corn was 1.66 billion bushels, a 24 percent increase compared to the previous marketing year (figure 3). In contrast to soybeans, planted corn acreage increased 4.6 million acres, nationwide. In part due to higher ending stocks being forecasted, the projected price of corn decreased to $4.20 per bushel. This is $0.10 lower than the previous year and below the long-run average.

Figure 3. Ending stock of corn and average farm price per marketing year, September 1 to August 31 (Source: WASDE, 2025) *Estimated **Projected

Stabilizing prices for soybeans and corn provide a relatively positive outlook for catfish feed prices. However, these forecasts should be used cautiously as historical data suggest the actual prices can easily be 10 percent above or below projections. Given the sheer magnitude of feed costs and the fact that small changes in price can result in major costs or savings for producers, there are some important considerations for farmers.

1. Monitor Commodity Markets for Soybean and Corn

Catfish producers should monitor commodity markets for soybeans and corn. The WASDE is a monthly publication that forecasts annual supply, use, and farm-level prices of various commodities, including corn, soybean, and soybean meal. The WASDE price forecasts are based on anticipated supply and use changes, futures markets, and historic price trends. The WASDE price forecasts are updated throughout the crop year as the USDA obtains new information on acres planted and crop yield projections.

Futures commodity prices are another tool that can give you a feel for the direction of the market. Futures prices are the agreed-upon price for the future delivery of a commodity and are determined through futures contracts. Futures commodity prices can reflect market expectations and will change as new production and market information becomes available. Futures commodity prices can be found on the Chicago Mercantile Exchange. Futures prices for soybean and corn are also posted weekly on the Profit Profiles page of the Alabama Extension website.

2. Booking Feed Prices

Given the potential for price increases, producers might consider booking a portion of their feed needs in advance to prevent paying higher prices later. Booking feed in advance can serve as a risk management strategy. If feed prices increase, the producer can avoid a portion of the increased feed cost. If feed prices decline, the producer can benefit from the portion of feed purchases not made in advance. In some cases, it may be beneficial to book a small portion of feed early and see how the prices are in a month or two. Under most circumstances, it is probably not advisable to book 100 percent of anticipated feed needs. The portion of feed that should be booked in advance should be based on spot prices, future price expectations, available capital, the farm’s acceptable level of risk, and other factors.

Takeaways

The current USDA projections show prices for soybeans and corn are expected to stabilize in the 2025-26 marketing year, suggesting a generally positive outlook for catfish feed prices. However, given production, economic, and political uncertainties, it is recommended that producers closely monitor soybean and corn markets because conditions can change quickly and as new production and economic information becomes available.