Farm Management

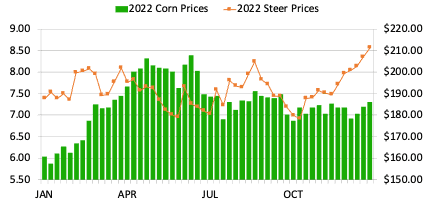

Figure 1. 2022 Corn and Steer Prices

Source: USDA-AMS, LMIC

There are always at least two sides to every story, and sometimes more than that. Such is the case with corn prices. Are high corn prices good? Well, it depends. Are you producing corn and trying to sell it ? Or are you a cattle producer wanting the best price on calves? If you are a corn farmer, certainly higher prices are a good thing, within reason. Prices being too high can lead to more corn planted and a surplus, which leads to lower prices. If you are a cattle producer and want high cattle prices, you would rather not have high corn prices.

The Corn/Cattle Relationship

There has historically been an inverse relationship between corn prices and feeder cattle prices (Figure 1.). As corn prices rise, cattle prices lower. When you examine their relationship, this makes a lot of sense. The majority of cattle in Alabama and the Southeast will be fed in feedlots throughout the Midwest and Southern Plains on a predominantly corn-based diet. The largest expenses of the feedlots are the cost of the cattle and the cost of the feed they are feeding those cattle. When the cost of the feed goes up, it means that what the feedlots are willing to pay for calves goes down.

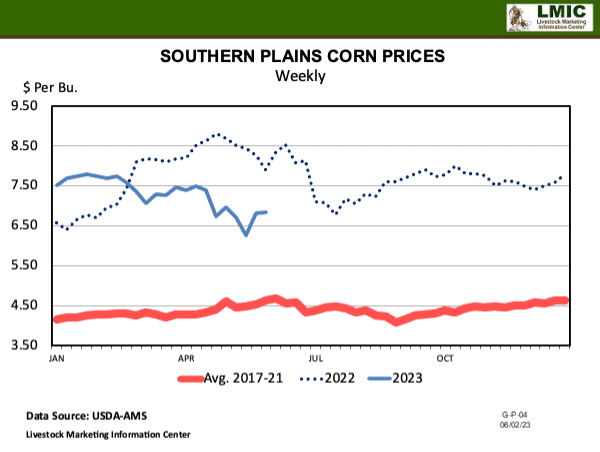

Figure 2. Southern Plains Corn Prices

Source: USDA-AMS, LMIC

Tonsor and Mollohan published a 2017 article in the Journal of Applied Farm Economics entitled Price Relationships Between Calves and Yearlings: An Updated Structural Change Assessment. This article discussed many of the dynamics between prices of calves and yearlings going through the feeding process, including the impact of rising corn prices. The study found that as corn increased 1 percent in price, yearling prices were reduced by 0.180 percent.

Current Outlook

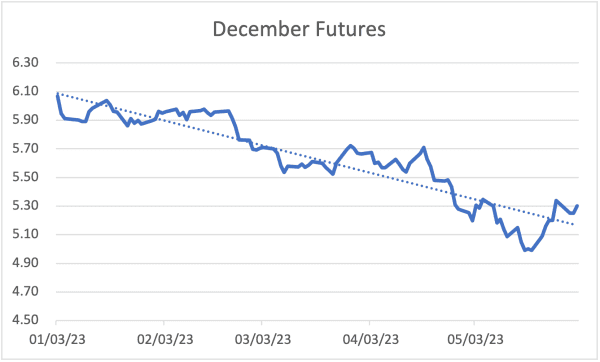

So, what does all of this mean now? Looking at corn prices, the short answer is corn prices are lower than 2022 prices, but they are still above the five-year average. When looking a little closer at what is happening this year, you find that cash corn prices have trended down since the beginning of the year. This is a negative for the corn farmer, but a positive for the cattle producer. The futures markets also show a projected weakening in corn prices going forward this year. December futures have trended downward since the beginning of the year. This can be attributed to several things, including a larger projected acreage in prospective plantings domestically, a large South American crop, and loss of some of the United States’ projected corn export contracts (China and Mexico).

Figure 3. December Futures

Source: USDA-AMS, LMIC

What does this mean for Alabama cattle producers? It is a part of the feeder calf pricing formula producers should use as they consider the market outlook for this year and next year. If corn prices continue at the current price projections, that provides support for continuing the current high feeder-calf prices.