Farm Management

Understanding the tax implications of selling cattle is crucial for a cattle producer. The example and completed tax forms provided here can serve as a guide to producers in their operations.

A hypothetical cattle operation has been devised to explain the income tax impact on cattle operations. The numbers reflect the revenue, expenses incurred to generate that income, fixed assets required to support the operation, and labor to manage the operation.

In this scenario, Ken is the sole member of Andalusia Cattle LLC. He has an off-farm job as his primary income and a herd of cows he manages on the side. The herd typically consists of thirty-five brood cows, two herd bulls, and thirty calves (half bulls and half heifers).

In 2021, Ken sold twenty-eight calves, two brood cows, and one bull. He kept two heifers for breeding stock and purchased two bred heifers for $1,831 each.

Ken purchased two bred heifers in 2020 for $1,800 each. He must allocate the fair market value of the cow to the cow and the remainder to the calf (see Gamble v. Commissioner, 68 T.C. 800 and Revenue Ruling 86-24). He allocated $1,550 of the purchase price to the cow and the remaining $250 to the calf.

Raised stock and purchased stock must be accounted for separately. The fifteen raised steers averaged 550 pounds and sold for $165/cwt or $13,612.50. The thirteen heifers averaged 500 pounds and sold for $143/ cwt or $9,295.00. The total revenue for the raised calves was $22,907.50. The two calves from the bred heifers purchased in 2020 weighed 600 pounds each and sold for a total of 1,980.00.

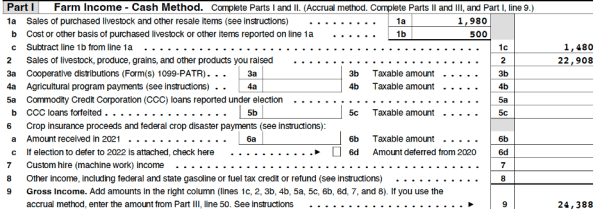

Schedule F, Part I Farm Income—Cash Method

See figure 1, Schedule F for Andalusia Cattle LLC. The purchased livestock are reported on line 1; this includes sales revenue of $1,980 on line 1a, the cost or basis of $500 on line 1b, and the net, $1,480, on line 1c.

Ken is allowed to depreciate the cost of the bred heifers bought in 2020, but not the cost of the calves in that year. For livestock purchased for resale, the purchase price must be deducted in the year of sale, not the year of purchase (Treas. Reg. §1.61-4(a)). Ken sold the two calves for $1,980 and deducted the allocated basis of $500 for the two calves for a net gain of $1,480 on the two calves from the bred heifers.

The sale of the raised livestock is reported on line 2. Raised livestock do not have a basis. The expenses to raise the calves are deducted in the year they are incurred and do not create a basis in the cattle. The line 2 amount of revenue is $22,908, and the gross Schedule F income for the cattle operation is $24,388.

The sale of livestock held for sale (as opposed to holding for breeding stock) produces ordinary income, which is subject to self-employment tax. For this example, expenses were half of the sales income from the 30 calves, 4 brood cows, and the bull or $14,946, leaving a Schedule F profit of $9,442.

Since Ken’s taxable income is greater than $19,900 and less than $81,050 (see figure 7), his marginal income tax rate is 12 percent. This means the sale of the cows generated an income tax liability of $1,133. Ken also owes self-employment tax on 92.35 percent of the net farm profit at the 15.3 percent rate (IRC Section 1401), or $1,334 of employment tax liability.

Figure 1. Schedule F Part I Farm Income—Cash Method for Andalusia Cattle LLC

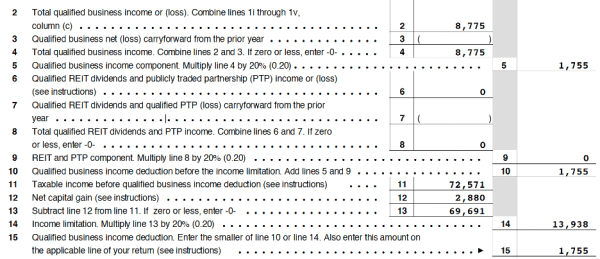

Form 8995: Qualified Business Income Deduction Simplified Computation

The Tax Cuts and Jobs Act reduced the income tax owed by corporations to 21 percent. This did not apply, however, to pass-through entities (general partnerships, limited partnerships, limited liability companies, and S-corporations) and sole proprietorships. In these cases, income tax liability was passed on to the individual owners, who included the amount on their individual returns.

Since the income tax rate of pass-through business owners was not decreased, Congress introduced the Qualified Business Income Deduction (QBID) to reduce the income tax effect on pass-through entities. The deduction is generally the lesser of 20 percent of the business income or 20 percent of the taxable income.

In Ken’s case, the QBID is $1,755 (see figure 2). Half the self-employment tax reduces the net farm income before computing the deduction. The $1,755 deduction results in income tax savings of $211.

Combining the income tax, self-employment tax, and QBID, the tax impact of the Schedule F operation is a net payment of $2,256, but Ken sold an additional four animals.

Figure 2. Form 8995 Qualified Business Income Deduction Simplified Computation

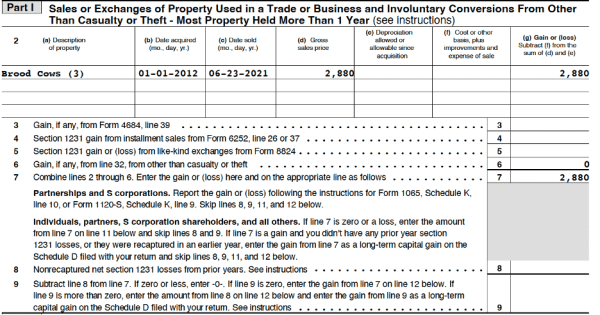

Property Used in the Trade or Business or Involuntary Conversion

The sale of the brood cows and the bull is not reported on Schedule F because they were not held for sale but for breeding. As such, they are property used in the trade or business. Code Section 1231, titled “Property Used in the Trade or Business or Involuntary Conversion,” allows any gains on the disposition of business property to be reported as capital gains, but any losses are deducted as ordinary losses. Property used in the trade or business includes cattle and horses, regardless of age, held by the taxpayer for draft, breeding, dairy, or sporting purposes and held for 24 months or more (Sec. 1231(b)(3)(A)).

“There shall be allowed as a depreciation deduction a reasonable allowance for the exhaustion, wear and tear . . . of property used in the trade or business, or of property held for the production of income” (Sec. 167). If depreciable property is disposed of, the amount realized that exceeds the adjusted basis up to the purchase price is treated as ordinary income” (Sec. 1245 (a)(1)).

Ken sold four brood cows in 2021. Three of the cows were raised and held for breeding; therefore, they are considered Section 1231 property. Since the cows were held for more than 24 months and there was a gain on the sale, it qualifies for long-term capital gains treatment.

Form 4797 Part I

Cull cows were selling for $80/cwt and averaged 1,200 pounds each for a sale price of $960 per cow. The sale of the three raised cows was reported on Form 4797, Part I (see figure 3).

Since the cows were raised, there was no basis and therefore no depreciation. The revenue from the three raised cull cows was $2,880.

Note in line 8 that any net Section 1231 losses from the prior 5 years must be deducted from the long-term capital gains. The instructions on line 9 indicate that the revenue is to be carried to Schedule D line 11: Gain from Form 4797.

Figure 3. Andalusia Cattle Company LLC Form 4797 Part I

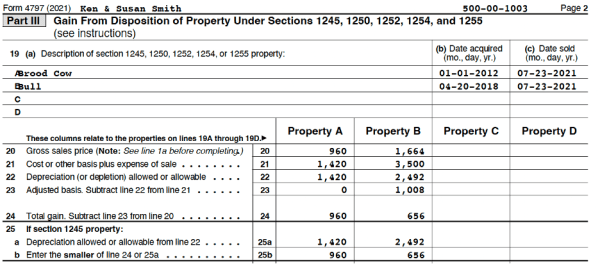

Form 4797 Part III

One of Ken’s cull cows was a purchased bred heifer. He had allocated $1,420 to the heifer when he bought it in 2012. Considered a 5-year property, this cow is now fully depreciated.

Since purchased cattle are considered Section 1245 property, Ken must recapture the depreciation he previously claimed. The cow sold for $960, but Ken is claiming $1,420 of depreciation. He does not have to recognize more than he realized, therefore he reports $960 on the form and does not have to recognize the additional $460 of depreciation (see figure 4).

Ken also sold a bull he purchased in 2018. If Ken had used ordinary depreciation rates, he would have deducted 20 percent of the purchase price in 2018, 32 percent in 2019, and 19.2 percent in 2020. He would not claim depreciation in the year of disposition.

Ken could have elected to use Section 179 treatment or bonus depreciation to write off the cost of the bull over a shorter period. In figure 4, note that line 22 states depreciation allowed or allowable. This means that even if you do not claim the allowable deduction, you still must report it and pay income tax on the amount at ordinary rates. In this example, under Property B, Ken has a taxable gain of $656. If he had fully depreciated the bull, his gain would have been $1,664.

Figure 4. Andalusia Cattle Company LLC Form 4797 Part III

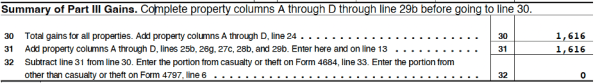

Form 4797 Summary of Part III Gain

The sales results are summarized in Summary of Part III Gains (figure 5). The total amount realized ($1,616) is reported on line 30. This amount is repeated on line 31 as the depreciation recapture. Since the $2,880 (figure 3) is gain from the sale of business property, and the $1,616 is depreciation recapture, they are not subject to self-employment tax.

Figure 5. Andalusia Cattle LLC Form 4797 Summary of Part III Gain

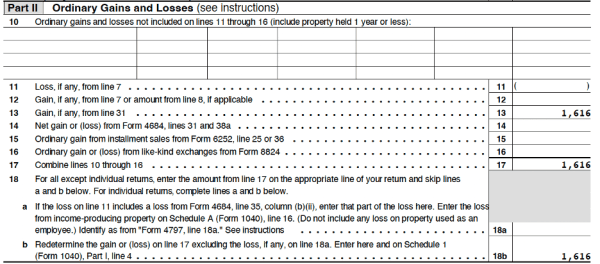

Form 4797 Part II Ordinary Gains and Losses

Form 4797 Part II (figure 6) is used to report short-term capital gains that are taxed at ordinary rates, not capital gains rates. The $1,616 of depreciation recapture is reported on line 13 and part of the total on line 18. The instructions in line 18b indicate that the revenue is to be reported on Schedule 1 of Form 1040.

Figure 6. Andalusia Cattle Company LLC Form 4797 Part II Ordinary Gains and Losses

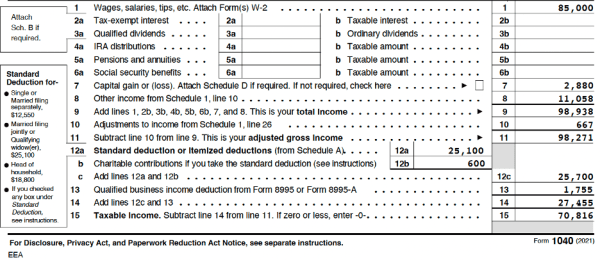

Form 1040

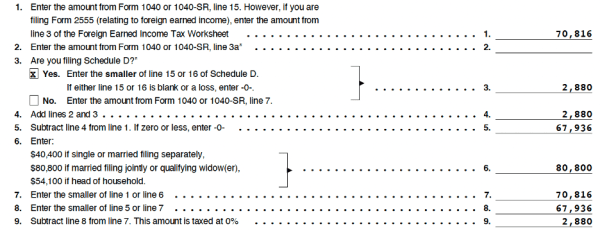

Capital gains rates for married individuals filing jointly in 2021 were 0 percent for taxpayers with taxable income of $80,800 or less, 15 percent for taxpayers with taxable income between $80,801 and $501,600, and 20 percent for taxable income greater than $501,600.

In this example, Ken earned $50,000 in his off-farm job, and his wife earned $35,000 from her job. They have two children and are using married filing joint status and standard deductions.

Lines 1 through 15 of their form 1040 are shown in figure 7. Line 1 reports their combined off-farm income of $85,000. Line 7 is the sale of the three heifers from schedule D. Line 8 is their other income, which consists of the $1,616 from depreciation recapture and $9,442 Schedule F net farm income. Line 10 is the deduction for half of the self-employment tax. After deductions, their taxable income is $70,816.

Figure 7. Form 1040 for Ken and Susan Smith

The capital gain is included in Ken’s taxable income, but the tax tables are not used to calculate the income tax. Because their taxable income is less than $80,800, the income tax rate on the $2,880 of long-term capital gains is 0 percent. See figure 8 for the calculations. Line 9 shows the $2,880 is taxed at 0 percent.

Anytime you have long-term capital gains, complete the worksheet to determine the amount taxed at 0, 15, and 20 percent. Even if your taxable income is greater than $80,800, some of your gains may be taxed at 0 percent.

Figure 8. Form 1040 calculations

Summary

Ken’s cattle operation generated $30,391 of revenue from the sale of thirty calves, four brood cows, and one bull. Expenses were $14,946. His tax bill was $2,256 for the calf operation, $194 for depreciation recapture on the sale of the purchased heifer and bull, $0 for the sale of the three cull cows, and a credit of $80 for the reduction in taxable income due to half of the self-employment tax. The total federal tax was $2,370.

Alabama has a single income tax rate for individuals and does not recognize capital gains. Ken’s Alabama farm income was $13,938, which was taxed at 5 percent or $697. The total tax bill was $3,067, leaving him with $12,378.

If Ken and his wife’s taxable income from off-farm jobs had exceeded $81,050, the federal marginal tax rate would have been 22 percent instead of 12 percent, and the amount of income tax owed to the IRS would have almost doubled. The Alabama tax would have been at the same rate.

The example of Andalusia Cattle LLC is for illustrative purposes only and may not reflect your individual operation. The income tax calculations and forms were generated using Drake Tax Software. This article does not constitute tax advice but only general knowledge of the impact of income tax on selling cattle. We suggest that you consult with an income tax professional before conducting a significant sale.

Ken Kelley, Regional Extension Agent, Farm and Agribusiness Management, and Robert Tufts, Professor Emeritus, both with Auburn University

Ken Kelley, Regional Extension Agent, Farm and Agribusiness Management, and Robert Tufts, Professor Emeritus, both with Auburn University

New December 2022, Reporting Cattle Operation Income to the IRS, ANR-2959