Farm Management

In the catfish industry, feed prices can be affected greatly by fluctuating prices in the corn and soybean markets. Thirty-two percent crude protein catfish feed contains 30 to 44 percent soybean meal, 15 to 20 percent corn grain, and up to 20 percent corn gluten feed. As corn and soybean prices rise, catfish fish feed prices do as well.

2021 Markets

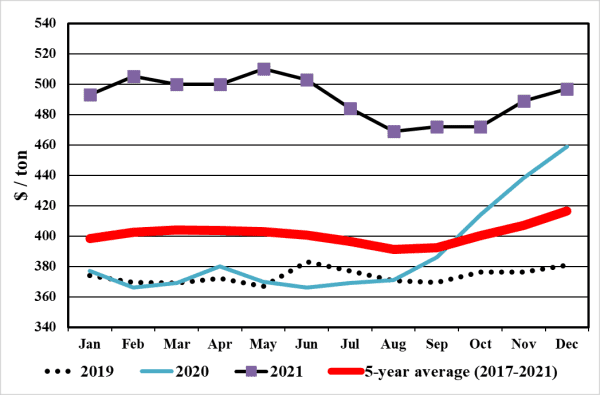

Catfish feed prices were high in the first half of 2021, at approximately $500 per ton (Figure 1). A decreased supply in corn and soybean production in the United States led to an increase in corn, soybean, and soybean meal prices (Figure 2). This decrease in crop supplies was caused by several items, including trade, drought, storm damage, and yield decreases. By mid-year, the outlook for these commodities improved and there was a $40 per ton decrease in catfish feed prices during the July through August period. This lower feed price did not last and the industry saw increased feed prices by the end of the year when it increased back to the $500 per ton level.

Fortunately for catfish producers in 2021, the price they received for the catfish sold to processors also increased, making the burden of higher feed prices less (Figure 3). However, feed prices are still a concern as this expenditure make up approximately 50 percent of all variable costs. Thus, it is important to try to understand which way catfish feed prices will head in the upcoming 2022 catfish production year.

Figure 1. Catfish feed prices for 32 percent protein feed in 2019, 2020, 2021, and the five-year average

Figure 2: Corn and Soybean Prices Since 2020. Source: Macrotrends.

Figure 3. Premium sized catfish (1 to 4 pounds) price to producer for 2019, 2020, 2021, and the five-year average

Overcoming High Feed Prices

Below are four approaches to understand catfish feed price movements and ways to adjust your operation to reduce expected high catfish feed costs in 2022.

Watch Futures Markets

Catfish producers should always keep an eye on the corn and soybean futures market prices. In addition to cash prices, which show the current price of the commodity, futures prices provide the markets’ prediction of what prices will be at different points throughout the year. The primary crop ingredients in catfish feed are soybean meal and corn, at about 50 and 37 percent, respectively. A producer can check futures markets through the Chicago Board of Trade. There, they can see futures contracts on corn and soybean derived from traders who are using all available information to ultimately determine future prices. To check on commodity future contract prices, visit the CME Group website and search for corn quotes, soybean quotes, or soybean meal quotes.

Future commodity prices are a pretty good summary of factors likely to influence market prices. When comparing current commodity prices with future contract prices six to eight months later in the year, future prices provide an idea of which way traders currently expect the commodity’s price will go. As shown in Tables 1-3, the future prices for each commodity are slowly decreasing over the next two to eight months. This reflects the seasonal nature of row crops, as prices decrease when supplies are the highest after harvest. However, conditions change quickly, and as new information about crop production becomes available, these future prices are adjusted accordingly. For instance, acreage planted to each crop and crop conditions will affect prices throughout the growing season.

Another tool to predict prices is the USDA World Agricultural Supply and Demand Estimates (WASDE). This publication estimates and projects farm-level prices for the entire marketing year for commodities. Corn, soybean, and soybean meal prices are all expected to be higher than what we have seen in recent years, as shown in Table 1. For example, corn prices were estimated at $3.56 per bushel in the 2019/2020 marketing year, $4.53 in 2020/2021, and are expected to reach $5.45 this current marketing year. The WASDE along with the futures prices suggest feed prices could continue to increase in 2022.

Table 1. Feed Corn Cash Prices, Future Prices, and Marketing-Year Average Prices in Prior Years

1 Futures Prices obtained from Chicago Mercantile Exchange; closing prices on March 7, 2022

2 Marketing-year average farm prices received, USDA World Agricultural Supply and Demand Estimates February 2022; Note that the marketing year begins September 1 for corn and soybeans and October 1 for soybean meal

| Timeframe | Corn ($/bu) | |

|---|---|---|

| Cash Price | 7.52 | |

| Futures Prices1 | May '22 | 7.49 |

| Futures Prices1 | Jul '22 | 7.51 |

| Futures Prices1 | Sep '22 | 6.74 |

| Futures Prices1 | Dec '22 | 6.43 |

| Prior Year Prices2 | 2021/2022 (Forecast) | 5.45 |

| Prior Year Prices2 | 2020/2021 | 4.53 |

| Prior Year Prices2 | 2019/2020 | 3.56 |

Table 2. Feed Soybean Cash Prices, Future Prices, and Marketing-Year Average Prices in Prior Years

1 Futures Prices obtained from Chicago Mercantile Exchange; closing prices on March 7, 2022

2 Marketing-year average farm prices received, USDA World Agricultural Supply and Demand Estimates February 2022; Note that the marketing year begins September 1 for corn and soybeans and October 1 for soybean meal

| Timeframe | Soybean ($/bu) | |

|---|---|---|

| Cash Price | 16.39 | |

| Futures Prices1 | May '22 | 16.59 |

| Futures Prices1 | Jul '22 | 16.34 |

| Futures Prices1 | Aug '22 | 15.80 |

| Futures Prices1 | Sep '22 | 15.00 |

| Futures Prices1 | Nov '22 | 14.53 |

| Prior Year Prices2 | 2021/2022 (Forecast) | 13.00 |

| Prior Year Prices2 | 2020/2021 | 10.80 |

| Prior Year Prices2 | 2019/2020 | 5.57 |

Table 3. Feed Soybean Meal Cash Prices, Future Prices, and Marketing-Year Average Prices in Prior Years( Duplicate )

1 Futures Prices obtained from Chicago Mercantile Exchange; closing prices on March 7, 2022

2 Marketing-year average farm prices received, USDA World Agricultural Supply and Demand Estimates February 2022; Note that the marketing year begins September 1 for corn and soybeans and October 1 for soybean meal

| Timeframe | Soybean Meal ($/ton) | |

|---|---|---|

| Cash Price | 474.90 | |

| Futures Prices1 | May '22 | 16.59 |

| Futures Prices1 | Jul '22 | 451.40 |

| Futures Prices1 | Aug '22 | 439.20 |

| Futures Prices1 | Sep '22 | 428.30 |

| Prior Year Prices2 | Oct '22 | 416.90 |

| Prior Year Prices2 | Dec '22 | 414.30 |

| Prior Year Prices2 | 2021/2022 (Forecast) | 410.00 |

| Prior Year Prices2 | 2020/2021 | 392.31 |

| Prior Year Prices2 | 2019/2020 | 299.50 |

Book Feed Prices

Booking catfish feed prices is not an all-or-nothing proposition. Given the potential for significant price increases in the future, producers might consider booking a portion of their feed needs. It may be good for producers to book some of their feed early and see how the prices are in one to two months. At that time, one can reconsider if additional feed should be booked or not. However, producers should check with their feed supplier to learn more about their booking requirements, such as minimum acceptable amounts, times for booking and delivery, payment method, etc.

Remember, it is not necessary and probably not advisable in most circumstances to book 100 percent of anticipated feed needs. However, lining up some portion of those needs may have some advantages and serve as a risk-management strategy. If feed prices go up significantly, at least a portion of that increased feed cost has been avoided. If feed prices decline, the producer can take advantage of that decline on the portion of feed purchases not made in advance. Also, having some feed booked may help a producer narrow down expected production expenditures and per-unit costs of production. This can help in developing financial plans for the coming year and if pre-paid—may help reduce taxes.

Alternative Feeding Strategies

Producers can consider alternative feeding strategies for unfavorable economic conditions. One of these strategies is feeding every other day instead of every day. Feeding strategies on farms are sensitive to the levels of available capital, feed price, and fish price. Under higher feed prices or tighter credit, every other day feeding may become necessary. However, at current feed and fish prices, feeding should be every day. Every other day feeding is optimal only when feed prices are extremely high. Feeding every third day is not an optimal feeding strategy. Be aware that switching to feeding every other day will decrease total fish produced. Many farmers will disagree with this strategy as they know more catfish pounds to sell is better than fewer pounds.

Producers can also try to reduce their cost of feeding by feeding a 28 percent protein diet, as the majority of producers in Mississippi do.

Ganesh Kumar, an aquaculture economist at the National Warmwater Aquaculture Center in Stoneville, Mississippi offers the following additional tips for alternative feeding strategies:

- Monitor feed budgets and talk with lenders.

- Reduce the need for feeding by stocking less in the 2022-2023 growing seasons.

- Stocking relatively larger fingerlings will provide a greater head start in production.

- Prioritize and feed ponds that have fish approaching market size.

- Feeding every day is the best strategy for production. However, every other day feeding becomes optimal when feed prices are approaching $500 per ton, though the price received for their live fish will need to be considered as well in making the feeding frequency decision.

Higher Prices Offsetting Costs

Currently, the bright spot for producers is that catfish prices are high now (Figure 3). The question is whether the higher fish prices will offset the higher feed costs. Producers can do a quick estimate to see whether they are making or losing money this year.

- Estimate feed costs by multiplying the expected feed quantity to be used by the expected higher feed price.

- Multiply the estimated feed costs by two, as feed is approximately 50 percent of total operating costs.

- Subtract the feed costs, and any other costs, from the expected sales revenue to calculate cash profit. Sales revenue is calculated by multiplying the quantity of live fish one expects to sell by the expected fish price.

There are a lot of unknowns here but substituting in several feed/fish quantities and several expected fish/feed prices will give producers a range of returns that can inform them about their chances for operational success.

Summary

The decision of whether or not to contract either input purchases or output sales can be a difficult one because there are seldom any right or wrong answers (without the benefit of hindsight, that is). Each producer must make an individual decision based on several factors. Perhaps the most important thing to consider is an individual’s willingness and ability to stand the existing price risk. In this decision, it is important for the producer to determine whether or not the potential exists for a loss that would jeopardize the financial stability or survivability of the operation. If so, some type of contracting or forward purchase or sale would be an effective means of reducing that risk to an acceptable level.