Forestry

Timber production is the second-largest agricultural commodity in Alabama. Understanding the factors related to market and price trends is essential for landowners and producers of timber products.

Alabama Timber Facts

Figure 1. TimberMart-South reporting regions in Alabama.

There are approximately 23 million acres of timberland in Alabama. This comprises 71 percent of the state’s total land area. Of the 48 contiguous states in the nation, Alabama is third in overall timberland coverage and second in private timberland coverage. Eighty- eight percent of timberland in the state is owned by nonindustrial private landowners. Of this timberland, approximately 44 percent is softwood stands, 43 percent hardwood stands, and 13 percent mixed hardwood/pine stands.

As of 2015, the production of timber in Alabama is second only to broilers (chickens raised for meat production) in all agricultural commodities. The timber products industry is likely to remain strong in the state for years to come, as money invested in new and expanding forestry products companies has been consistent. Investments in the state’s forest industry increased by nearly 29 percent from 2014 to 2015 alone.

Timber price reports for Alabama are produced by TimberMart-South (TMS), based in the Warnell School of Forestry and Natural Resources at the University of Georgia. TMS provides quarterly and annual timber price updates, market newsletters, and historical price reports for eleven southern states.

Timber prices in Alabama are divided into two reporting regions, Northern and Southern (fig. 1). For this publication, timber prices reflect the average annual nominal (not adjusted for inflation) stumpage price per ton for north Alabama, south Alabama, and statewide.

Stumpage Price Trends

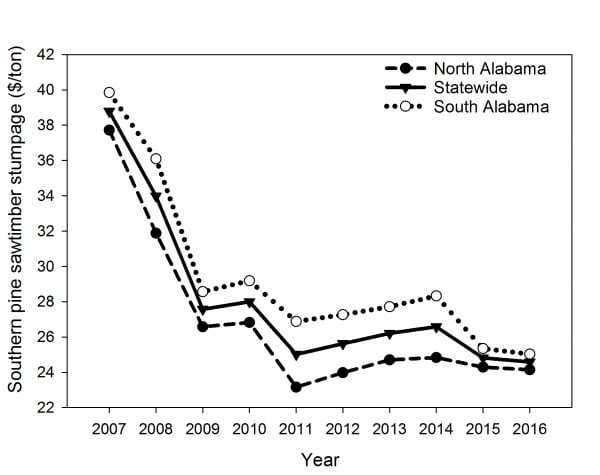

Figure 2. Average annual southern pine sawtimber stumpage nominal price from 2007 through 2016 for north Alabama, statewide, and south Alabama timber regions.

Southern pine sawtimber

The average price per ton of southern pine sawtimber in Alabama decreased by 37 percent in the decade 2007–2016. The average price per ton was 8.7 percent higher per year in the south region compared to the Northern Region, although prices decreased similarly for both (fig. 2). The decrease can be attributed largely to the housing market crash of 2008. Between 2009 and 2011, five sawmills in the state closed.

With slight improvement in the housing market, southern pine sawtimber harvests have increased in recent years. More sawmills are resuming operation, and new sawmills are scheduled to open. Nevertheless, southern pine sawtimber prices have not rebounded; this can be attributed largely to the surplus of sawtimber class southern pine in the state.

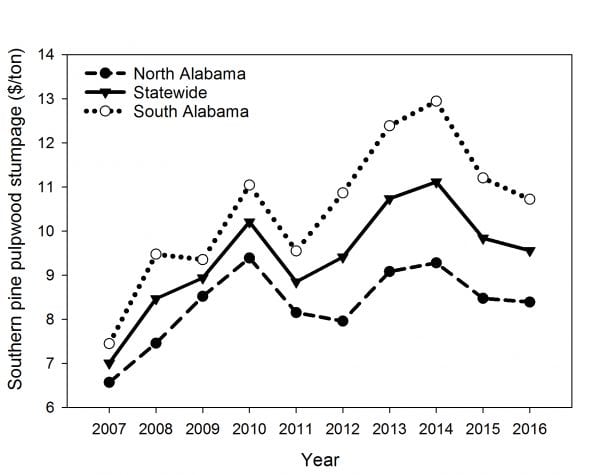

Southern pine pulpwood

The average price per ton of southern pine pulpwood in Alabama increased by 34 percent in the decade 2007–2016. It averaged 20.6 percent higher per year in the Southern Region compared to the Northern Region (fig. 3). The price per ton also fluctuated more than that of southern pine sawtimber (fig. 3).

The demand for southern pine pulpwood is likely to remain high in the coming years due to increased demand by manufacturers of wood pellets and paperboard packaging, and to a strong global market for pulp and paper.

Figure 3. Average annual southern pine pulpwood stumpage nominal price from 2007 through 2016 for north Alabama, statewide, and south Alabama timber regions.

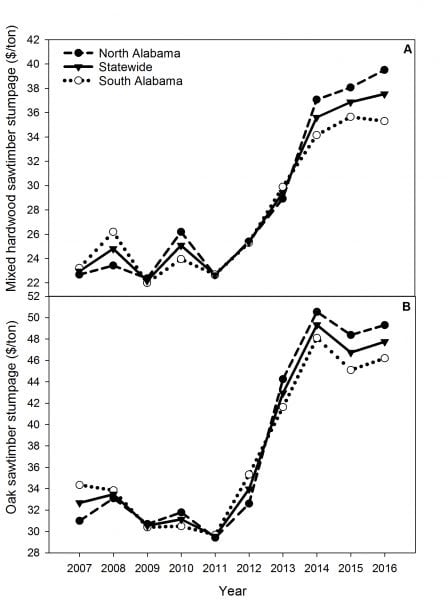

Mixed hardwood sawtimber and oak sawtimber

The most dramatic increase in stumpage price in the decade 2007–2016 was in mixed hardwood sawtimber and oak hardwood sawtimber.

The average price per ton of mixed hardwood sawtimber in Alabama increased by 64 percent, peaking in 2016 (fig. 4). Stumpage fluctuated between 2007 and 2011, before considerably increasing each year thereafter (fig. 4A). Beginning in 2014, hardwood sawtimber stumpage averaged 8.3 percent higher per ton in the Northern Region compared to the Southern Region (fig. 4A).

Similarly, oak sawtimber stumpage increased considerably in price from 2012 through 2014, before holding relatively steady in 2015 and 2016 (fig. 4B). The average price per ton across the state increased by 46 percent in the decade 2007–2016, peaking in 2014 (fig. 4B). Beginning in 2013, oak sawtimber stumpage averaged 5.9 percent higher per ton in the Northern Region compared to the Southern Region (fig. 4B).

High hardwood sawtimber prices are linked to a strong demand for hardwood lumber exports; 2014 and 2015 were record years for exports. An increase in the housing market, increases in demand for pallet and railroad tie materials, and an overall improving domestic economy also support high stumpage prices. In addition, there is a high demand for white oak logs used to make whiskey barrel staves. Brown-Forman Corporation, which specializes in making oak staves for whiskey barrels, opened a mill in Stevenson, Alabama, in 2012 that maintains a constant demand for high-quality oak logs.

Figure 4. Average annual sawtimber stumpage nominal price for mixed hardwood (A) and oak (B) from 2007 through 2016 for north Alabama, statewide, and south Alabama timber regions.

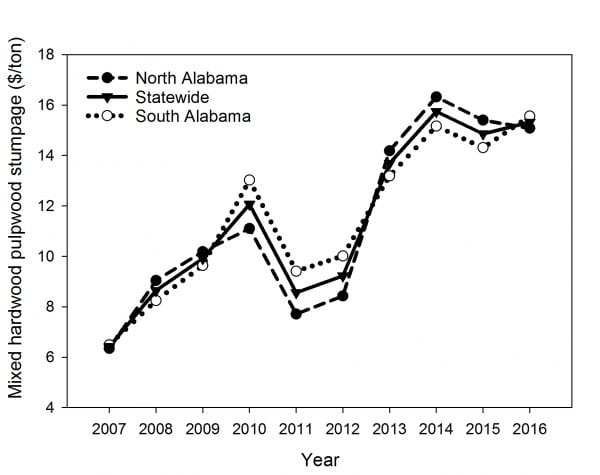

Mixed hardwood pulpwood

The average price per ton of mixed hardwood pulpwood in Alabama more than doubled in the decade 2007–2016 (fig. 5). The peak average price per ton was in 2014 (fig. 5).

Mixed hardwood pulpwood stumpage increased in both regions of the state from 2007 through 2010. It then decreased abruptly in 2011, before increasing considerably from 2012 through 2014 (fig. 5). Stumpage prices were fairly consistent between the Northern and Southern regions. They were separated by an average of about a dollar per ton over the 10-year period.

Mixed hardwood pulpwood production has been on the decline in recent years as a result of decreasing demand for hardwood pulpwood products such as newspaper and writing paper. In addition, southern pine pulpwood is cheaper for mills to produce; demand is therefore increasing for that over hardwood pulpwood.

Conclusion

Along with a strong or improving economy, housing market, and demand for products, other factors such as precipitation can have an effect on timber prices. One consistency among the different timber types and size classes is the decrease in stumpage prices in 2011. This was due in part to decreased precipitation in 2010 that continued into much of 2011, causing a readjustment in the timber market.

Above-average precipitation in 2013 paired with increases in the housing market and demand for pulp and paper led the way for a rebound in timber prices. This was reflected by increases in stumpage prices in 2013 and 2014.

Stumpage prices for southern pine pulpwood in the decade 2007–2016 was fairly consistent. In general, this can be attributed to strong markets for global pulp and paper, oriented strand board (OSB), and wood pellets, as well as the lack of available chip residues from sawmills.

Figure 5. Average annual mixed hardwood pulpwood stumpage nominal price from 2007 through 2016 for north Alabama, statewide, and south Alabama timber regions.

Stumpage price reports provide insight into recent trends and the current timber market demand. These reports can be useful when contemplating selling timber by providing a general idea of what timber is worth. Prices can fluctuate widely, however; this is especially true for sawtimber and other high-value timber products.

There are multiple items to consider along with price when contemplating selling timber and determining the fair market value of a specific timber sale. The fair market value of a certain stand of timber will vary broadly based on specific factors such as species, size class, quality of timber, volume, logistics (e.g., logging conditions and distance to the mill), current demand, and local competition of timber.

From a financial standpoint, landowners deciding whether or not to sell their timber should consider the timber value growth rate and alternative rate of return (discount rate). The value growth rate can be determined for an individual tree or stand. It is estimated from the value increase of an individual tree or stand from one year to the next and then dividing that value by the previous value of the tree or stand. This can be done annually or over a specific time period greater than a single year (e.g., every 5 years).

If the value growth rate is less than the discount rate, then the decision would be to harvest the stand. If the value growth rate is greater than the discount rate, then the landowner should postpone the harvest for at least another year.

There are many items to consider that can affect short-term and long-term goals when contemplating a timber harvest. Many decisions to harvest are financially driven and motivated by high timber prices or the need for income. Forest health, resiliency, and sustainability should also be considered in the harvest decision.

For more information on financial analysis of forestland, see A Guide to Analyzing Forestry Profit Potential (ACES publication FOR-2007) at www.aces.edu.

Additional Resources

Forest Resource Report 2015, Alabama Forestry Commission

www.forestry.state.al.us/PDFs/AlabamaForestResourceReport.pdf

Forestry News, Alabama Cooperative Extension System

www.aces.edu/natural-resources/forestry

Forestry Products, Alabama Department of Commerce

www.madeinalabama.com/industries/industry/forestry-products

Timber Markets Review–January 2016, FORECON

www.foreconinc.com/timber-markets-review-january-2016

TimberMart-South

www.timbermart-south.com

WARN List, Alabama Department of Commerce

www.madeinalabama.com/warn-list

Wood Supply Trends in the US South 1995–2015, Forest2Market, Inc.

www.theusipa.org/Documents/USSouthWoodSupplyTrends.pdf

Download a PDF of Alabama Stumpage Price Trends (2007–2016), FOR-2048.